Single-Use Bioprocessing Market Insights

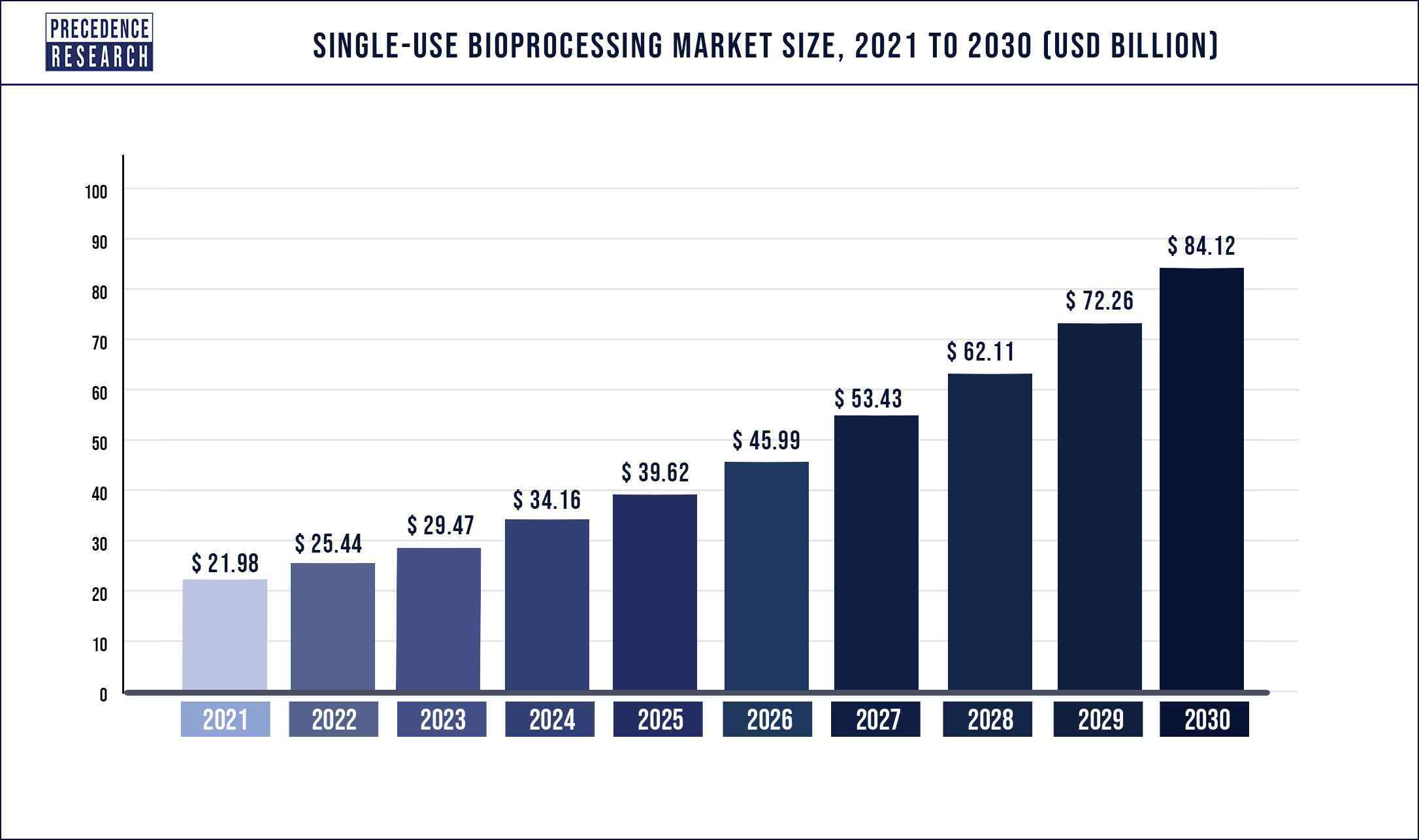

The global single-use bioprocessing market size accounted for US$ 25.44 billion in 2022 and is expected to hit US$ 84.12 billion by 2030, growing at a CAGR of 16.1% from 2022 to 2030.

Single-use bioprocessing systems are known for developing pharmaceuticals such as medicines, vaccines, and monoclonal antibodies by using disposable or single-use technologies. The use of single-use bioprocessing technologies during the development phase of drugs has witnessed exponential growth in the past few years.

The single-use bioprocessing technologies are being used increasingly by the contract manufacturers in biopharmaceutical industry for acquiring the benefits such as low investment, low environmental footprint, and reliability. This is one of the primary factors propelling the growth of the global single-use bioprocessing market.

The growing geriatric population is boosting the market growth significantly. The growing prevalence of chronic conditions and diseases amongst the old age population is boosting the demand for the biopharmaceutical medicines.

According to the United Nations, the old age population of 65 years or above will reach up to 1.5 billion by 2050. This is estimated to foster the single-use bioprocessing market in the future. Moreover, increasing investments in the development of numerous vaccines, drugs, and diagnostic tests is positively impacting the market growth.

Single-use Bioprocessing Market Growth Factors:

- Rapid growth of the biopharmaceutical industry

- Growing government investments in the development of vaccines and drugs

- Rapid technological developments by the key players

- Rising government expenditure on developing healthcare infrastructure

- Increasing activities of the contract development manufacturing organizations

- Growing popularity of disposables in the biopharmaceuticals

Single Use Bioprocessing Market Report Scope

| Report Coverage | Details |

| Market Size By 2030 | USD 84.12 Billion |

| Growth Rate From 2022 to 2030 | CAGR of 16.1% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Product, End User, Application, Workflow, Region |

| Companies Mentioned | PBS Biotech, Inc., Thermo Fisher Scientific, Inc., Sartorius AG, Merck KGaA, Entegris, Inc., Pall Corporation, Corning Incorporated, Eppendorf AG, Infors AG, General Electric Company (GE Healthcare), Lonza, Rentschler Biopharma SE |

Report Highlights

- By product, the media bags and containers segment led the global single-use bioprocessing market with remarkable revenue share in 2020. This is due to the benefits associated with the media bags and containers such as low capital requirement, saving of cost in sterilization and cleaning, operating scale flexibility, quick batch changeover and quick deployment, and cleaning validation elimination.

- By application, the filtration segment led the global single-use bioprocessing market with remarkable revenue share in 2020. This is attributed to the increasing adoption of single-use bioprocessing system in filtration owing to its flexibility. It is applicable in a wide variety of biopharmaceutical applications depending on the type of solutions used and is very much effective in eliminating viruses and other such cultures.

- By End User, the biopharmaceutical manufacturer segment led the market in 2020 as rapid growth of biopharmaceuticals industry. Biopharmaceutical industry alone represents over 20% of the total pharmaceutical industry and is rapidly growing across the markets like North America and Europe.

Also Read: Home Healthcare Market to Expand by 14.2% By 2027

Regional Stance

North America is the leading single-use bioprocessing market owing to the increased spending on healthcare, technological development in bioprocessing, and growing importance of life science research. Growing adoption of disposable systems and increased energy efficiency coupled with the minimal risk of product cross-contamination are the beneficial factors associated with the use of single-use bioprocessing products. Further, the introduction of automation, big data technology, and artificial intelligence in the single-use system has been gaining rapid traction in North America.

These latest technologies in the manufacturing units are expected to boost production and helps the manufacturers to achieve cost-efficiency and reduce wastages.The presence of a large number of big and small contract manufacturing organizations in the region are increasingly using the single-use bioprocessing technology due to its low cost and improved output. The increased economic activity of these contract manufacturers will significantly drive the growth of the single-use bioprocessing market in North America.

Asia Pacific is characterized by growing production of biosimilars, cell therapy, vaccines, and various other types of biopharmaceutical products. Moreover, China is the second largest biopharmaceutical market just after the US. China’s economic policies to attract FDIs for setting up manufacturing plants for biopharmaceutical products is exponentially fostering the demand for single-use bioprocessing technology.

Moreover, nations like India, Japan, and South Korea have been a leading player in the Asia Pacific region. Biocon of India and Samsung Biologics of South Korea have earned FDA and European Medicines Agency approval respectively, for their new biosimilar products in 2017. Therefore, the single-use bioprocessing market has huge growth potential in the Asia Pacific region.

Single-use Bioprocessing Market Dynamics

Drivers – The single-use bioprocessing market is significantly driven by the growing demand from the biopharmaceutical industry. Majority of the biopharmaceutical companies are increasingly adopting the single-use bioprocessing technology because the single-use bioprocessing systems increases the efficiency in the process and reduces the costs associated with sterilization, cleaning, and maintenance of steel bioreactors. This drives the higher adoption of disposable bioprocessing systems in the biopharmaceutical industry.

Restraints – The Bio-Process System Alliance has published a set of tests to be performed regarding the extractable and leachable contamination. The leachable and extractable are the unwanted products produced by the single-use bioprocessing system. The disposable bioprocessing system are made of plastic and often faces contamination issues. This may hamper the single-use bioprocessing market growth.

Opportunities – The emerging markets such as China and India have a high growth potential. The growing investments by the major players, growing geriatric population, and rapidly growing biotechnology in the industry is providing lucrative growth opportunities to the single-use bioprocessing market players.

Challenges – The plastic wastes generated by the disposable bioprocessing system is a major challenge faced by the market players due to the growing environmental concerns and government regulation regarding plastic wastes.

Recent Developments

- In December 2020, Thermo Fisher Scientific launched a single-use bioreactor for manufacturing cell culture.

- In March 2020, GE Healthcare’s Biopharma business was acquired by Danaher Corporation and now Biopharma is renamed as Cytiva.

Single-use Bioprocessing Market Key Players

Some of the major players in the single-use bioprocessing market include:

- Thermo Fisher Scientific, Inc.

- Sartorius AG

- Merck KGaA

- Pall Corporation

- Corning Incorporated

- Eppendorf AG

- General Electric Company (GE Healthcare)

- Lonza

- Rentschler Biopharma SE

- JM BioConnect

- Meissner Filtration Products, Inc.

- Infors AG

- BoehringerIngelheim GmbH

- Entegris, Inc.

- PBS Biotech, Inc.

Market Segmentation

By Product

- Filtration Assemblies

- Disposable Bioreactors

- Disposable Mixers

- Media Bags & Containers

- Others

By Application

- Filtration

- Purification

- Cell Culture

- Others

By End User

- Biopharmaceutical Manufacturers

- Clinical & Academic Research Institutes

- Others

By Workflow

- Upstream

- Fermentation

- Downstream

Regional Segmentation

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Southeast Asia and Rest of APAC)

- Latin America (Brazil and Rest of Latin America)

- Middle East and Africa (GCC, North Africa, South Africa, Rest of MEA)

Research Methodology

Secondary Research

It involves company databases such as Hoover’s: This assists us to recognize financial information, the structure of the market participants and industry’s competitive landscape.

The secondary research sources referred in the process are as follows:

- Governmental bodies, and organizations creating economic policies

- National and international social welfare institutions

- Company websites, financial reports and SEC filings, broker and investor reports

- Related patent and regulatory databases

- Statistical databases and market reports

- Corporate Presentations, news, press release, and specification sheet of Manufacturers

Primary Research

Primary research includes face-to-face interviews, online surveys, and telephonic interviews.

- Means of primary research: Email interactions, telephonic discussions and Questionnaire-based research etc.

- In order to validate our research findings and analysis, we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Single-Use Bioprocessing Market, By Product

7.1. Single-Use Bioprocessing Market, by Product Type, 2021-2030

7.1.1. Filtration Assemblies

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Disposable Bioreactors

7.1.2.1. Market Revenue and Forecast (2019-2030)

7.1.3. Disposable Mixers

7.1.3.1. Market Revenue and Forecast (2019-2030)

7.1.4. Media Bags & Containers

7.1.4.1. Market Revenue and Forecast (2019-2030)

7.1.5. Others

7.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Single-Use Bioprocessing Market, By Application

8.1. Single-Use Bioprocessing Market, by Application, 2021-2030

8.1.1. Filtration

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Purification

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Cell Culture

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Single-Use Bioprocessing Market, By End User Type

9.1. Single-Use Bioprocessing Market, by End User Type, 2021-2030

9.1.1. Biopharmaceutical Manufacturers

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Clinical & Academic Research Institutes

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Single-Use Bioprocessing Market, By Workflow Type

10.1. Single-Use Bioprocessing Market, by Workflow Type, 2021-2030

10.1.1. Upstream

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Fermentation

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Downstream

10.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Single-Use Bioprocessing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2019-2030)

11.1.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.1.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.1.5. U.S.

11.1.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.5.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.1.5.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.1.6. Rest of North America

11.1.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.1.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.6.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.1.6.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.2.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.2.5. UK

11.2.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.5.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.2.5.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.2.6. Germany

11.2.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.6.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.2.6.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.2.7. France

11.2.7.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.7.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.2.7.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.2.8. Rest of Europe

11.2.8.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.8.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.8.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.2.8.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.3.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.3.5. India

11.3.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.5.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.3.5.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.3.6. China

11.3.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.6.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.3.6.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.3.7. Japan

11.3.7.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.7.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.3.7.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.3.8. Rest of APAC

11.3.8.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.8.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.8.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.3.8.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.4.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.4.5. GCC

11.4.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.5.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.4.5.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.4.6. North Africa

11.4.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.6.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.4.6.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.4.7. South Africa

11.4.7.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.7.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.4.7.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.4.8. Rest of MEA

11.4.8.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.8.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.8.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.4.8.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.5.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.5.5. Brazil

11.5.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.5.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.5.5.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

11.5.6. Rest of LATAM

11.5.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.5.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.6.3. Market Revenue and Forecast, by End User Type (2019-2030)

11.5.6.4. Market Revenue and Forecast, by Workflow Type (2019-2030)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sartorius AG

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Merck KGaA

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Pall Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Corning Incorporated

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Eppendorf AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. General Electric Company (GE Healthcare)

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Lonza

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Rentschler Biopharma SE

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. JM BioConnect

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. Meissner Filtration Products, Inc.

12.11.1. Company Overview

12.11.2. Product Offerings

12.11.3. Financial Performance

12.11.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1308

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Frequently Asked Questions Of This Report

- What is the size of the single-use bioprocessing market?

- What is the CAGR of the single-use bioprocessing market?

- Who are the major players in the single-use bioprocessing market?

- Which are the driving factors of the single-use bioprocessing market?

- Which region will lead the global single-use bioprocessing market?

- Which is the leading segment in a product offered?

- Enteral Feeding Devices: Valuable Niche in Medical Devices - November 18, 2022

- Largest Sleep Apnea Device Companies Between 2022 to 2027 - November 15, 2022

- Orthopedic Devices Market Size US$ 56.23 Bn By 2030 - November 14, 2022