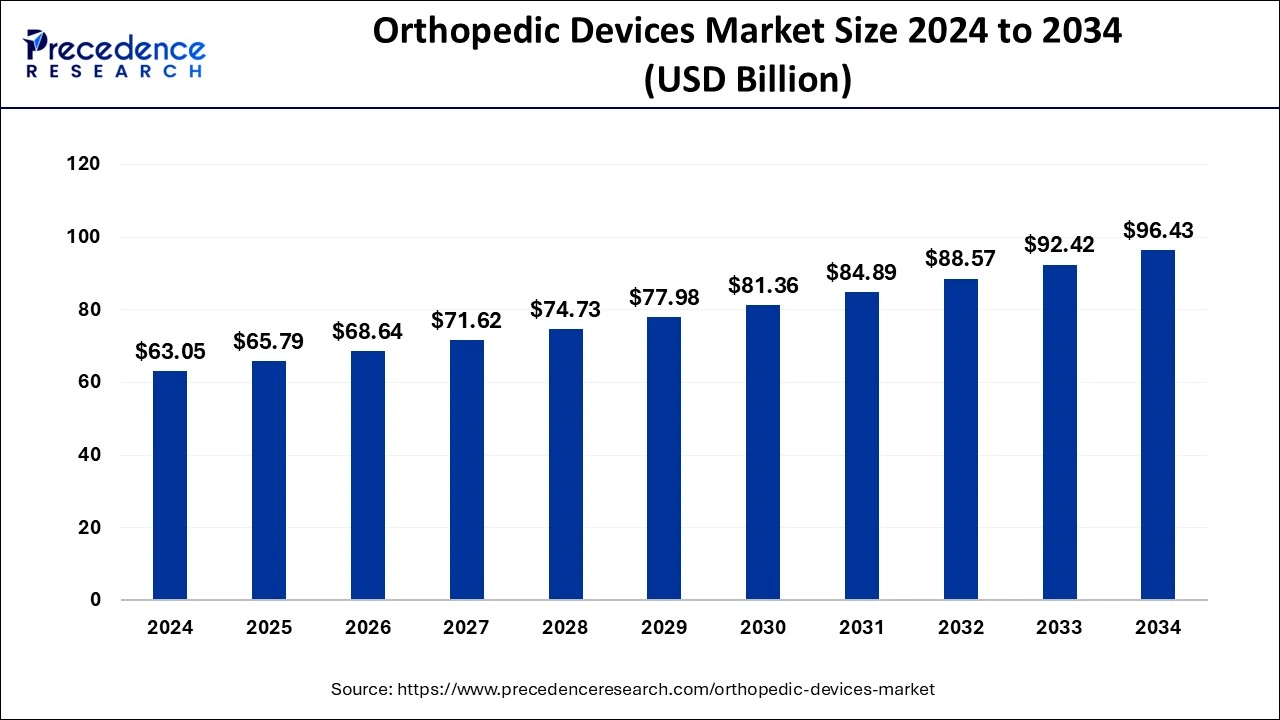

The global orthopedic devices market size was accounted at USD 65.79 billion in 2024, and it is anticipated to attain around USD 96.43 billion by 2034 with a CAGR of 4.34%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1027

Market Key insights

- North America secured the top position in the global market in 2024, holding a 46% share.

- From 2025 to 2034, Asia Pacific is anticipated to grow at the fastest CAGR.

- In terms of application, knee orthopedic devices dominated the market share in 2024.

- Surgical devices led the product segment in 2024 with the highest market share.

AI’s Role in the Orthopedic Devices Market

Artificial intelligence is transforming the orthopedic devices market by enhancing precision in diagnosis, treatment planning, and surgical procedures. AI-powered imaging and predictive analytics improve patient outcomes by enabling early detection of musculoskeletal disorders. Robotics-assisted surgeries and AI-driven rehabilitation solutions are further optimizing efficiency, reducing recovery times, and improving overall patient care.

Market Dynamics

Market Drivers

The growing number of orthopedic surgeries, coupled with an increasing elderly population susceptible to joint disorders, is a major market driver. Rising awareness about early treatment options further contributes to industry growth.

Opportunities

Advancements in regenerative medicine, coupled with the rising preference for minimally invasive procedures, provide ample opportunities. Government initiatives supporting orthopedic healthcare also play a key role.

Challenges

The orthopedic devices market faces challenges such as high product development costs, lengthy regulatory approval processes, and the risk of post-surgical infections, which can limit adoption rates.

Regional Insights

North America dominates due to extensive research and high patient awareness, whereas Europe benefits from well-established healthcare policies. Asia-Pacific is anticipated to experience substantial growth due to increasing disposable income and better healthcare accessibility.

Orthopedic Devices Market Companies

- Medacta

- DePuySynthes

- Smith & Nephew

- Stryker

- Medtronic

- Zimmer Biomet

- MicroPort Scientific Corporation (Wright Medical Group)

- DJO Global

- ConforMIS

- NuVasive

- Globus Medical

Latest Announcement by Industry Leader

- In November 2024, Auxein showcased its latest innovations in orthopedic products at MEDICA 2024, which took place from November 11 to 14 in Düsseldorf, Germany. A range of innovative orthopedic products introduced by the company include Reusable Suture Passer, Ligament Augmentation Repair Instrument Set, Knee Escorpian Suture Passer, and many more, which received an overwhelming response from thousands of industry professionals, experts, and healthcare providers. Mr. Rahul Luthra, Vice President of Global Sales & Marketing at Auxein, said that the overwhelming interest in these products is a testament to the global recognition of Auxein’s commitment to advancing orthopedic products.

Recent Developments

- In June 2024, Meril launched a surgical robotic technology, MISSO, which will provide assistance to doctors during knee replacement surgeries in real-time.

Segments Covered in the Report

By Product Type

- Joint Reconstruction

- Knee Replacement

- Revision Knee Replacement Implants

- Total Knee Replacement Implant

- Partial Knee Replacement Implant

- Elbow & Shoulder Replacement

- Hip Replacement

- Hip Resurfacing Implant

- Total Hip Replacement Implant

- Partial Hip Replacement Implant

- Revision Hip Replacement Implant

- Others

- Knee Replacement

- Orthopedic Prosthetics

- Upper Extremity Orthopedic Prosthetics

- Lower Extremity Orthopedic Prosthetics

- Spinal Devices

- Spinal Non-fusion Devices

- Spinal Fusion Devices

- Trauma Fixation

- Nails and Rods

- Metal Plates & Screws

- Pins/Wires

- Others

- Arthroscopy Devices

- Orthopedic Accessories

- Removal systems

- Bone cement

- Casting system

- Orthopedic Braces and Supports

- Upper Extremity Braces and Supports

- Low Extremity Braces and Supports

- Others

By End-user

- Ambulatory Surgical Centers

- Hospitals

- Orthopedic Clinics

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Scleral Lens Market Size to Gain USD 982.68 Bn by 2034 - April 11, 2025

- Water for Injection Market Size to Attain USD 87.39 Billion by 2034 - April 10, 2025

- ELISpot and FluoroSpot Assay Market Size to Reach USD 576.59 Million by 2034 - April 10, 2025