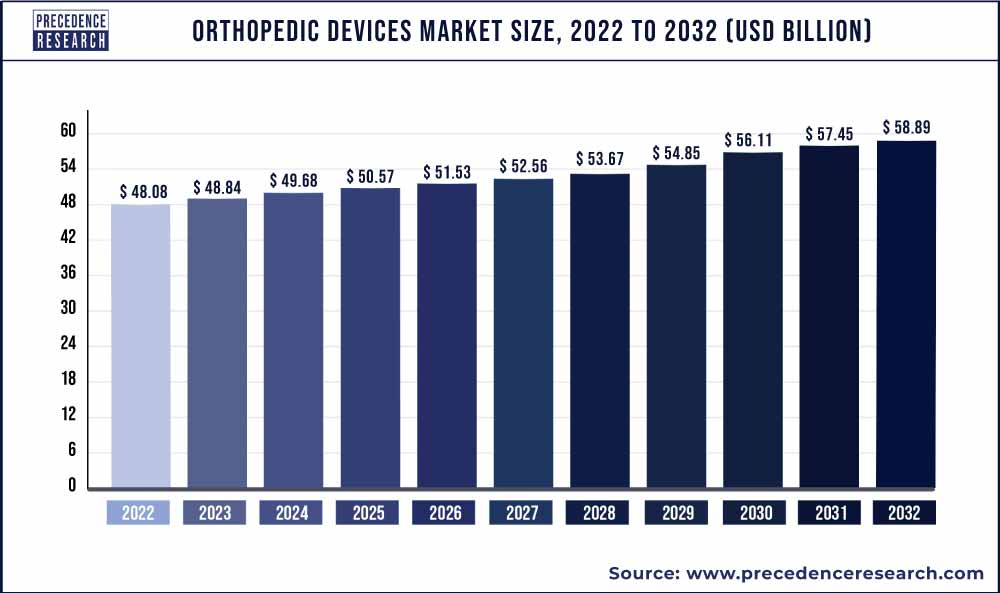

The global orthopedic devices market size is expected to reach around USD 58.89 bn by 2032 from USD 48.08 billion in 2022 with a CAGR of 2.10% from 2023 to 2032.

Key Takeaway

- North America region has accounted highest revenue share for 48% in 2022.

- By application, the knee orthopedic devices segment has held revenue share of over 29.51% in 2022.

- By products, the surgical devices segment has captured 56% revenue share in 2022. However, the accessories segment is growing at a CAGR of 3.5% from 2023 to 2032.

- Asia Pacific is poised to grow at the fastest CAGR from 2023 to 2032.

Orthopedic devices are intended to inhibit or manage musculoskeletal harms, while straighten fragile limbs or joints. They are employed to substitute missing bone or joints or to offer support to the injured bone. Orthopedic surgeries that integrate robotics are less invasive and provide reproducible precision, subsequent in less hospital stays and quicker recovery times. In Switzerland, La Source clinics tasted a reduction in average hospitalization from 10 to 6 days by means of surgical robots. However, this technology is still costly to obtain, and robust, evidence-based studies are desirable to validate that robotic technology front-runners to improved outcomes.

Orthopedic devices are manufactured with the help of stainless steel and titanium alloys for strength, and plastic coating works as synthetic cartilage. In orthopedics, internal fixation is a surgery that involves incorporation of implants to heal the injured bone. Most general orthopedic medical devices are the pins, rods, screws, and plates that are utilized for fastening of fractured bones while they heal. At present, several biotechnology firms are employing stem cells for orthopedic treatment. For instance, BioTime emphases on stem cell therapies for age-linked degenerative ailments, Bio-Tissue on orthobiological solutions for cartilage flaws and IntelliCellBioSciences on adipose-derived stem cells for orthopedic diseases.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1027

Growth Factors

The global orthopedic devices market is expected to grow at a noteworthy rate during the estimate period on account of the increasing elderly population across the world. Aged people are highly prone to progress bone associated disorders which is estimated to upsurge demand for countless orthopedic devices and implants from this population. Further, escalating frequency of obesity and diabetes, absence of physical activity, poor diet, and intensifying trend of alcohol consumption and smoking are some more factors that can lead injury to bone health. This will offer alluring prospects for orthopedic devices market in the near future.

The number of people undertaking joint replacement surgeries like total knee and hip replacement has augmented gradually and endures to upsurge, owing to a growth in the aging population. The upsurge in the musculoskeletal diagnoses and osteoporosis-related fractures is motivating the demand for orthopedic implants amongst the populace aged 65 years or older. The global orthopedic device market is compelled by the rising government focus on plummeting disease charge burden due to rising incidence of aged population.

Report Scope of the Orthopedic Devices Market

| Report Highlights | Details |

| Market Size | USD 58.89 Billion by 2032 |

| Growth Rate | CAGR of 2.10% from 2023 to 2032 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, End User, Region Type |

Report Highlights

- Global orthopedic devices market is extremely fragmented. Market companies emphasis on constant product advancements and proposing orthopedic devices at competitive prices, particularly in emerging nations.

- High pervasiveness of orthopedic conditions along with implementation of progressive treatment procedures is predicted to prosper growth of the market in the U.S.

- Minimally invasive orthopedic devices that do not need repeat procedures are estimated to lift the quantity of procedures in the established and emergent regions.

Regional Snapshots

North America dominated global orthopedic devices market in 2019 due to high demand for progressive healthcare services and existence of well-built healthcare infrastructure. Further, presence of market giants and repayment coverage are some of the factors motivating the regional growth of the market.

As per Arthritis Research report (UK), on “The State of Musculoskeletal Health 2018”, approximately 17.8 million people are projected to live with a musculoskeletal disorder in the UK, which is about 28.9% of the total population. These statistics demonstrate that the number of orthopedic surgeries is growing progressively, which may lead to surge in the demand for orthopedic implants in this region.

Demand for orthopedic surgeries in India and China is also anticipated to grow extremely in the nearby future. Moreover, growing medical tourism, due to the obtainability of cost efficient and cutting-edge healthcare treatment selections, than other regions, and cumulative implementation of innovative technologies are boosting the demand for the orthopedic devices t in Asia Pacific.

Key Players & Strategies

Companies financing significantly in robotics include Stryker, Zimmer Biomet, Smith & Nephew, Mazor Robotics, OMNlife Science Inc., Think Surgical, Verb Surgical and Intuitive Surgical. For illustration, Zimmer Biomet incorporated the ROSA robotic device utilized for spine and brain surgeries to its product selection via its acquisition of Medtech. Stryker acquired Mako Surgical Corp. in order to construct total knee and total hip replacement robotic products. Further, Smith & Nephew acquired Blue Belt Holdings for partial knee replacements for a robotic-assisted surgery product.

Read Also: Healthcare Cloud Computing Market Will be USD 62.47 Billion by 2030

Key Companies & Market Share Insights

Different players are focusing on constant product development and proposing orthopedic devices at viable prices particularly in emerging countries. Minimally invasive orthopedic devices that do not need repeat procedures are projected to lift the number of procedures in established as well as emerging regions. Some of the significant players in the orthopedic devices market include:

- Medacta

- DePuySynthes

- Smith & Nephew

- Stryker

- Medtronic

- Zimmer Biomet

- MicroPort Scientific Corporation (Wright Medical Group)

- DJO Global

- ConforMIS

- NuVasive

- Globus Medical

Segments Covered in the Report

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2016 to 2027. This report includes market segmentation and its revenue estimation by classifying it on the basis of end-use and region as follows:

By Product Type

- Joint Reconstruction

- Knee Replacement

- Revision Knee Replacement Implants

- Total Knee Replacement Implant

- Partial Knee Replacement Implant

- Elbow & Shoulder Replacement

- Hip Replacement

- Hip Resurfacing Implant

- Total Hip Replacement Implant

- Partial Hip Replacement Implant

- Revision Hip Replacement Implant

- Others

- Knee Replacement

- Orthopedic Prosthetics

- Upper Extremity Orthopedic Prosthetics

- Lower Extremity Orthopedic Prosthetics

- Spinal Devices

- Spinal Non-fusion Devices

- Spinal Fusion Devices

- Trauma Fixation

- Nails and Rods

- Metal Plates & Screws

- Pins/Wires

- Others

- Arthroscopy Devices

- Orthopedic Accessories

- Removal systems

- Bone cement

- Casting system

- Orthopedic Braces and Supports

- Upper Extremity Braces and Supports

- Low Extremity Braces and Supports

- Others

By End-user

- Ambulatory Surgical Centers

- Hospitals

- Orthopedic Clinics

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Table of Content:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sourcesa

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Orthopedic Devices Market, By Product

7.1. Orthopedic Devices Market, by Product Type, 2023-2032

7.1.1. Joint Reconstruction

7.1.1.1. Knee Replacement

7.1.1.2. Elbow & Shoulder Replacement

7.1.1.3. Hip Replacement

7.1.1.4. Market Revenue and Forecast (2020-2032)

7.1.2. Orthopedic Prosthetics

7.1.2.1. Market Revenue and Forecast (2020-2032)

7.1.3. Spinal Devices

7.1.3.1. Market Revenue and Forecast (2020-2032)

7.1.4. Trauma Fixation

7.1.4.1. Market Revenue and Forecast (2020-2032)

7.1.5. Arthroscopy Devices

7.1.5.1. Market Revenue and Forecast (2020-2032)

7.1.6. Orthopedic Accessories

7.1.6.1. Market Revenue and Forecast (2020-2032)

7.1.7. Orthopedic Braces and Supports

7.1.7.1. Market Revenue and Forecast (2020-2032)

7.1.8. Others

7.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 8. Global Orthopedic Devices Market, By Application

8.1. Orthopedic Devices Market, by Application, 2023-2032

8.1.1. Ambulatory Surgical Centers

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Hospitals

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Orthopedic Clinics

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Orthopedic Devices Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product (2020-2032)

9.1.2. Market Revenue and Forecast, by Application (2020-2032)

9.1.3. U.S.

9.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

9.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

9.1.4. Rest of North America

9.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

9.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product (2020-2032)

9.2.2. Market Revenue and Forecast, by Application (2020-2032)

9.2.3. UK

9.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

9.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

9.2.4. Germany

9.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

9.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

9.2.5. France

9.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

9.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

9.2.6. Rest of Europe

9.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

9.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product (2020-2032)

9.3.2. Market Revenue and Forecast, by Application (2020-2032)

9.3.3. India

9.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

9.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

9.3.4. China

9.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

9.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

9.3.5. Japan

9.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

9.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

9.3.6. Rest of APAC

9.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

9.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product (2020-2032)

9.4.2. Market Revenue and Forecast, by Application (2020-2032)

9.4.3. GCC

9.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

9.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

9.4.4. North Africa

9.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

9.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

9.4.5. South Africa

9.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

9.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

9.4.6. Rest of MEA

9.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

9.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product (2020-2032)

9.5.2. Market Revenue and Forecast, by Application (2020-2032)

9.5.3. Brazil

9.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

9.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

9.5.4. Rest of LATAM

9.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

9.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 10. Company Profiles

10.1. Medacta

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. DePuySynthes

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Smith & Nephew

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Stryker

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Medtronic

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Zimmer Biomet

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. MicroPort Scientific Corporation (Wright Medical Group)

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. DJO Global

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. ConforMIS

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. NuVasive

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

10.11. Globus Medical

10.11.1. Company Overview

10.11.2. Product Offerings

10.11.3. Financial Performance

10.11.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/