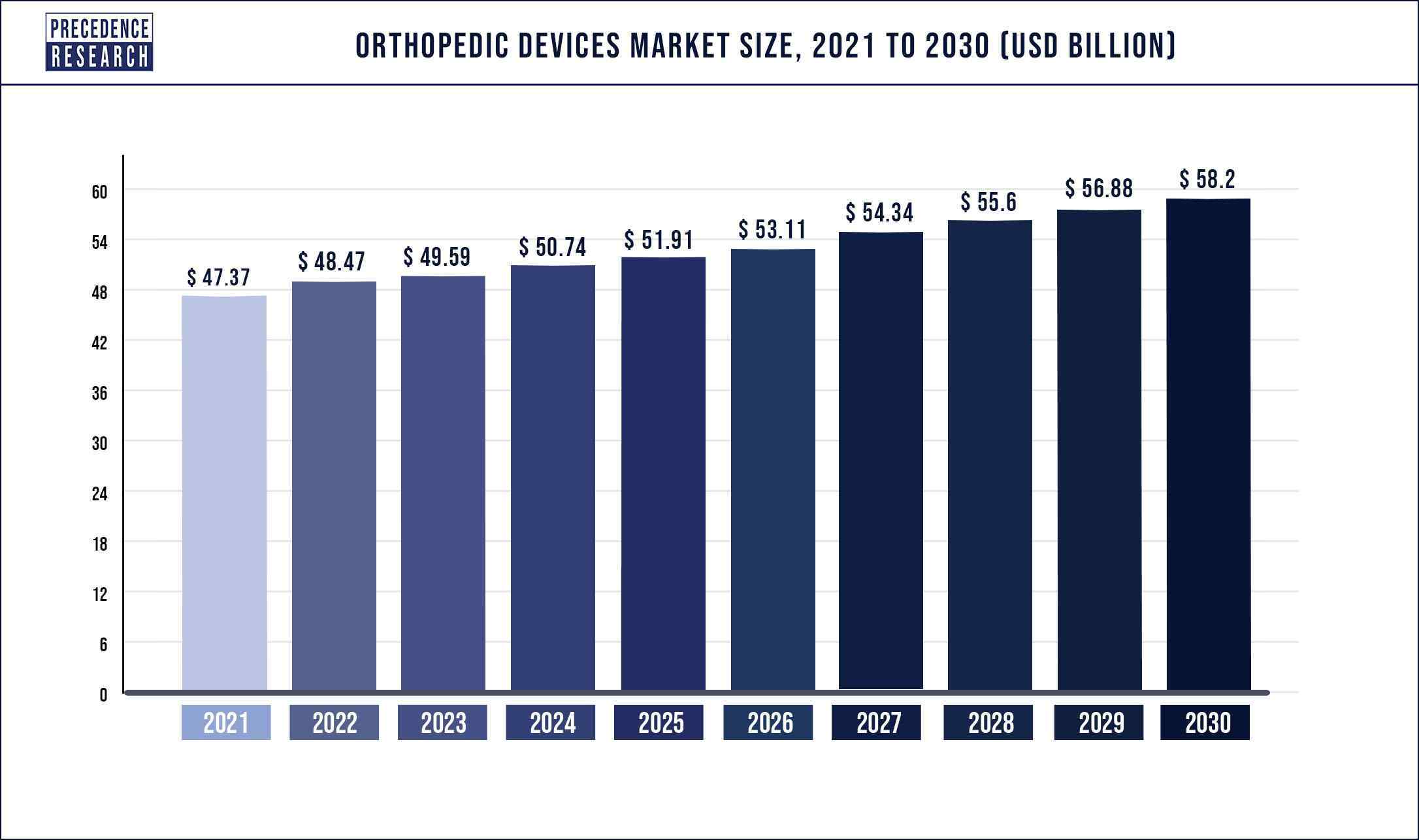

The global orthopedic devices market size accounted for USD 48.47 billion in 2022 and is projected to hit around USD 56.23 billion by 2030, growing at a CAGR of 2.31% from 2022 to 2030.

By the end of 2022, the market for orthopedic devices is expected to develop at a faster rate than that of cardiology and in vitro diagnostics. This industry will continue to be a strong one for medical technology worldwide. Growing senior populations, a high prevalence of orthopedic disorders such degenerative bone disease, and the number of traffic mishaps are all predicted to fuel the expansion of the worldwide orthopedic devices market.

In addition, it is anticipated that the market would rise due to the early development of musculoskeletal disorders brought on by obesity and a sedentary lifestyle. Hospitals are being pushed to constantly improve their services and equipment due to a growing knowledge of how accessible cutting-edge products are.

Download a Free Sample Copy of this Report@ https://www.precedenceresearch.com/sample/1027

Orthopedic Devices Market Growth

The high prevalence of orthopedic conditions, including degenerative bone disease, as well as the ageing population’s increase in mobility and the rise in traffic accidents, all contribute to the market’s expansion. In addition, the early onset of musculoskeletal problems, mostly brought on by obesity and a sedentary lifestyle, is anticipated to fuel market expansion. Because there are currently no effective surgical tools, trauma care techniques cannot fully restore bodily components.

Manufacturers are putting a lot of money into research and development to create cutting-edge and effective equipment as a result. In the near future, it is projected that this rise in R&D activity will guarantee strong market growth. Technology advances and an increase in the prevalence of various bone-related illnesses are predicted to further expand the market.

Orthopedic Devices Market Report Scope

| Report Highlights | Details |

| Market Size | USD 58.2 Billion by 2030 |

| Growth Rate | CAGR of 2.31% from 2022 to 2030 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Product, End User, Region Type |

Report Highlights

- Product Insight: As a result of the growing need for orthopedic devices among consumers, the joint reconstruction product sector has led the worldwide orthopedic devices market among other product categories. The strict FDA approval requirements and significant investments, however, are expected to cause this segment to lose market share to the spinal devices segment near the conclusion of the projection period. As the population ages and the need for non-invasive support grows, the market for spinal devices is predicted to grow rapidly.

- End-user Insight: Hospitals, ambulatory surgical centers, and orthopedic clinics are a few examples of different end-users of orthopedic devices. In terms of revenue share of the overall market, the hospital segment dominated the worldwide orthopedic devices market in 2021.

Regional Analysis

Due to its advanced healthcare system and rising orthopedic surgery rates, the United States dominated the North American orthopedic devices market in 2020, accounting for over 94% of total revenue. The amount of amputations and traffic accidents in the United States are expected to rise, which will expand the market for these devices there.

In 2020, Germany accounted for around USD 1.9 billion and held the greatest revenue share in the European market, thanks to rising healthcare costs and initiatives to reduce significant health risks. Europe’s highest healthcare spending is accounted for by Germany. Its healthcare spending per person increased noticeably from USD 4,612 in 2010 to USD 5,472 in 2018.

Orthopedic Devices Market Dynamics

Drivers

The orthopedic device market has grown into a multi-billion-dollar business with steady growth in both developed and developing countries as a result of extensive R&D successes and various advancements. The government’s increased focus on the declining disease cost burden brought on by the ageing population is driving the worldwide orthopedic device industry.

It is anticipated that in the near future, spectacular growth will be fueled by the rising prevalence of osteoporosis and arthritis. As a result of rising acceptability in emerging markets and market saturation in developed countries, developing economies are expected to grow faster than those in developed ones.

Also Read: Portable Medical Devices Market Sales to Hit USD 85.05 Bn By 2027

Restraints

Due to the cancellation of elective treatments, low demand, and weak sales, the COVID-19 pandemic had a negative effect on the market. Due to supply chain interruptions, company closures, travel limitations, staff illness or quarantines, stay-at-home policies, and other prolonged interruptions, businesses also had to deal with operational issues. To avoid cross-infection and to accommodate the demand for treating COVID-19 patients, numerous public health organizations in the U.S., for example, suggested delaying elective procedures.

Opportunities

Growing elderly population and increase in orthopedic illnesses will increase market value. The study on the ageing of the world population by the United Nations estimates that 727 million individuals worldwide are 65 or older. By the end of 2050, the population is projected to double and reach 1.5 billion. According to projections, the proportion of older people in the world population would increase from about 9.3% in 2020 to 16% by 2050. The majority of orthopedic disorders are caused by ageing and are expected to rise as the population ages.

Challenges

The rate at which these devices are used by surgeons and patients is impacted by product recalls as a result of inadequate design or manufacturing, which lowers sales for the producers.

Recent Development

- Smith & Nephew expanded their sports medicine portfolio in March 2018 by introducing the Q-FIX CURVED, Q-FIX MINI, and SUTUREFIX CURVED All-Suture Anchor systems.

- Stryker Spine acquired FDA 510(k) clearance in March 2018 to market Tritanium TL, a hollow, 3D-printed posterior lumbar interbody fusion cage that combines solid and porous components at the same time using AMagine, Stryker’s exclusive additive manufacturing process.

- Sentio, LLC, which is run by Innovative Surgical Solutions, LLC, was purchased by DePuy Synthes in June 2017. For spine surgery, Innovative Surgical Solutions is involved in the commercialization of nerve localization technologies. This transaction is anticipated to bolster DePuy Synthes’ position in the spine industry and improve Johnson & Johnson’s medical devices business.

Orthopedic Devices Market Key Players:

- Medacta

- DePuySynthes

- Smith & Nephew

- Stryker

- Medtronic

- Zimmer Biomet

- MicroPort Scientific Corporation (Wright Medical Group)

- DJO Global

- ConforMIS

- NuVasive

- Globus Medical

Market Segmentation

By Product Type

- Joint Reconstruction

- Knee Replacement

- Revision Knee Replacement Implants

- Total Knee Replacement Implant

- Partial Knee Replacement Implant

- Elbow & Shoulder Replacement

- Hip Replacement

- Hip Resurfacing Implant

- Total Hip Replacement Implant

- Partial Hip Replacement Implant

- Revision Hip Replacement Implant

- Others

- Knee Replacement

- Orthopedic Prosthetics

- Upper Extremity Orthopedic Prosthetics

- Lower Extremity Orthopedic Prosthetics

- Spinal Devices

- Spinal Non-fusion Devices

- Spinal Fusion Devices

- Trauma Fixation

- Nails and Rods

- Metal Plates & Screws

- Pins/Wires

- Others

- Arthroscopy Devices

- Orthopedic Accessories

- Removal systems

- Bone cement

- Casting system

- Orthopedic Braces and Supports

- Upper Extremity Braces and Supports

- Low Extremity Braces and Supports

- Others

By End-user

- Ambulatory Surgical Centers

- Hospitals

- Orthopedic Clinics

- Others

Regional Segmentation

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Southeast Asia and Rest of APAC)

- Latin America (Brazil and Rest of Latin America)

- Middle East and Africa (GCC, North Africa, South Africa, Rest of MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333

- Enteral Feeding Devices: Valuable Niche in Medical Devices - November 18, 2022

- Largest Sleep Apnea Device Companies Between 2022 to 2027 - November 15, 2022

- Orthopedic Devices Market Size US$ 56.23 Bn By 2030 - November 14, 2022