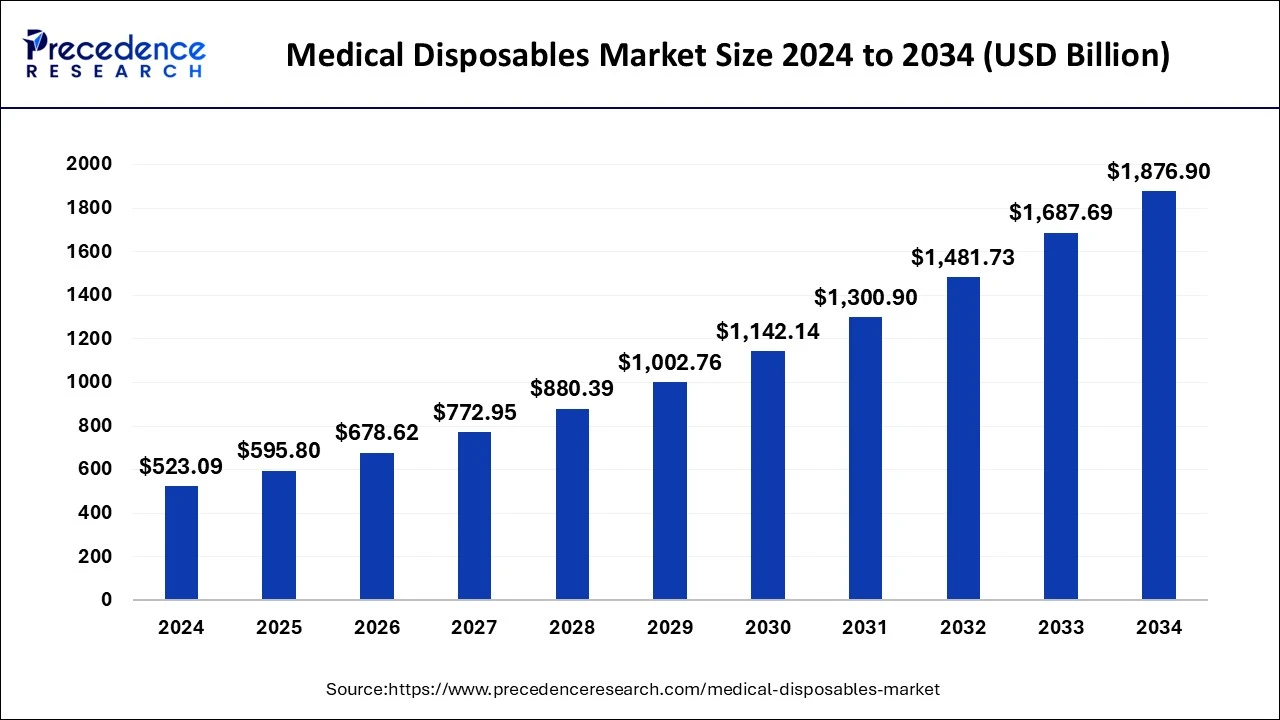

The global medical disposables market size was estimated at USD 523.09 billion in 2024 and is projected to attain around USD 1,876.90 billion by 2034, growing at a CAGR of 13.90%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1014

Market Key Takeaways

- North America maintained a leading position in the medical disposables market with a revenue share of 34.73% in 2024.

- Sterilization supplies represented 15% of the total market revenue in 2024.

- Plastic resins were the primary raw material, making up 59% of the revenue share in 2024.

- Hospitals remained the largest end-use sector, holding more than 56% of the total revenue share in 2024.

Market Overview

The medical disposables market is growing rapidly due to the increasing demand for hygiene and infection control in healthcare settings. These products, which include items like syringes, gloves, catheters, and wound care products, are essential in hospitals, clinics, and home healthcare environments. The market is driven by advancements in healthcare infrastructure, rising healthcare needs, and an increasing focus on preventing cross-contamination and hospital-acquired infections. With an expanding global population and rising health awareness, the medical disposables market is set to continue its upward trajectory.

Market Drivers

The medical disposables market is driven by factors such as rising healthcare expenditures, the increasing number of surgeries and medical procedures, and a growing preference for disposable items to ensure hygiene.

Government initiatives promoting healthcare access, along with an increasing focus on sanitation and infection control, have contributed to market growth. Furthermore, the rapid advancements in healthcare infrastructure and medical technologies are expanding the demand for disposable medical products across various healthcare sectors.

Market Opportunities

Opportunities in the medical disposables market are emerging from innovations in product development and materials. Biodegradable and eco-friendly medical disposables are gaining traction as sustainability becomes more of a focus within the healthcare industry.

Additionally, the growing trend of home healthcare and self-medication is increasing the demand for disposable products. Emerging markets in developing regions also offer substantial opportunities for growth as healthcare access improves, and there is greater adoption of disposable healthcare solutions.

Market Challenges

Despite the positive growth outlook, the medical disposables market faces several challenges. Cost pressures on healthcare systems and hospitals can limit the adoption of higher-quality, innovative products. Environmental concerns related to the disposal of single-use products are also a growing issue.

Additionally, there are concerns about the safety and quality of medical disposables, which require strict regulatory compliance. The market also faces supply chain disruptions and the rising cost of raw materials, particularly in regions with manufacturing constraints.

Regional Insights

Regionally, North America dominates the medical disposables market, holding a significant share due to advanced healthcare infrastructure and high healthcare spending. Europe follows closely, driven by increasing healthcare needs and stringent regulations.

The Asia-Pacific region is expected to experience the fastest growth, fueled by rising healthcare access, improved medical facilities, and an aging population. Latin America and the Middle East are emerging markets that are experiencing steady growth, driven by expanding healthcare systems and rising demand for disposable medical products.

Medical Disposables Market Companies

- Bayer AG

- BD

- Smith & Nephew PLC

- Cardinal Health

- Medline Industries, Inc.

- 3M

- MED-CON Inc.

- Medtronic

- Boston Scientific

- Becton, Dickinson and Company

- Pfizer

- Johnson and Johnson

Recent Developments

- In December 2022, the largest and most varied manufacturer of healthcare goods in the world, Johnson & Johnson, stated that the acquisition of Abiomed, Inc. was complete. Abiomed will now function as a stand-alone company within Johnson & Johnson’s MedTech division. Abiomed is now a part of Johnson & Johnson.

- In April 2021, Cardinal Health was given a contract worth $57.8 million, with options that, if exercised by the U.S. Department of Health and Human Services (HHS), could increase it to $91.6 million. This was for the preservation and allocation of around 80,000 pallets of PPE to encourage the Strategic National Stockpile, a division of the department of the Assistant Secretary for Preparedness and Response within HHS.

- In April 2021, for its $450 million injectables production, Pfizer used VR, robotics, and sterile technology. Never stepping foot inside, new production employees were familiar with the tools and processes at Pfizer’s forthcoming sterile injectables facility.

Segments Covered

By Product

- Wound Management Products

- Hand Sanitizers

- Gel Sanitizers

- Foam Sanitizers

- Liquid Sanitizers

- Other Sanitizers

- Non-woven Disposables

- Disposable Masks

- Disposable Eye Gear

- Disposable Gloves

- Drug Delivery Products

- Diagnostics and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

- Respiratory Supplies

- Sterilization Supplies

- Others

By Raw Material

- Plastic Resins

- Nonwoven Material

- Rubber

- Paper and Paperboard

- Metals

- Glass

- Others

By End-use

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- Asia Pacific

- China

- Japan

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Scleral Lens Market Size to Gain USD 982.68 Bn by 2034 - April 11, 2025

- Water for Injection Market Size to Attain USD 87.39 Billion by 2034 - April 10, 2025

- ELISpot and FluoroSpot Assay Market Size to Reach USD 576.59 Million by 2034 - April 10, 2025