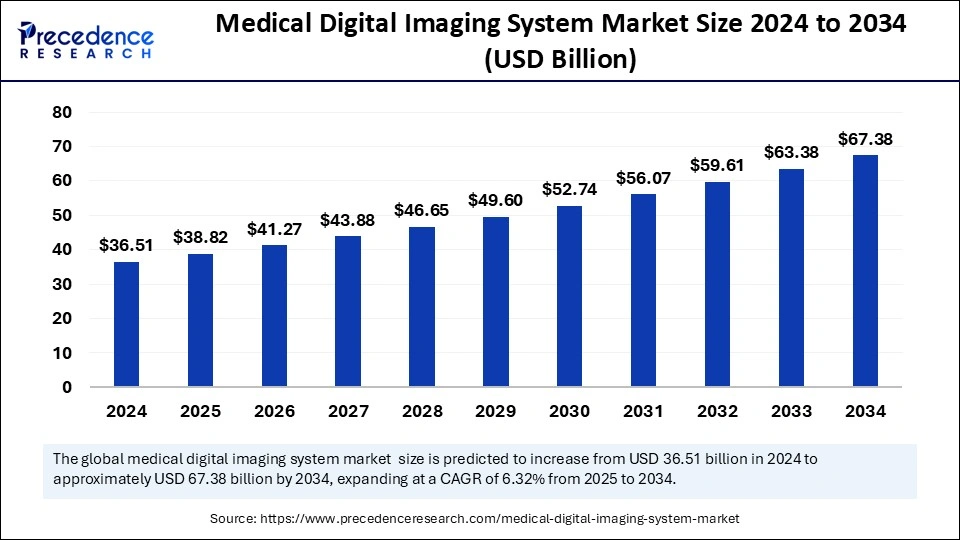

The global medical digital imaging system market size is expected to attain around USD 67.38 billion by 2034, increasing from USD 36.51 billion in 2024, with a CAGR of 6.32%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5794

Medical Digital Imaging System Market Key Takeaways

Regional Insights

-

North America held the highest regional market share at 35% in 2024.

-

Asia Pacific is expected to grow fastest at a CAGR of 6.92%.

By Component

-

Hardware led the segment with 61% market share in 2024.

-

Software is forecast to grow at a CAGR of 6.71% during the projection period.

By Modality

-

Computed tomography accounted for the largest share at 29% in 2024.

-

Nuclear imaging (PET/SPECT) is projected to grow at 7.4% CAGR.

By Deployment

-

On-premises deployment captured a 43% market share in 2024.

-

Cloud-based deployment is expanding at 6.8% CAGR.

By Application

-

Diagnostic imaging led with 61% market share in 2024.

-

Therapeutic imaging is projected to expand at 6.4% CAGR from 2025.

By End Use

-

Hospitals contributed 53% of the total market in 2024.

-

Diagnostic imaging centers are growing at a CAGR of 6.6%.

AI’s impact on the Medical Digital Imaging System Market

Enhancing Diagnostics and Efficiency

Artificial Intelligence is significantly transforming the medical digital imaging system market by improving the speed and accuracy of diagnostics. AI algorithms can analyze complex imaging data—including CT, MRI, PET, and X-ray scans—much faster than traditional methods, enabling earlier detection of conditions such as cancer, cardiovascular diseases, and neurological disorders. These systems can highlight anomalies, prioritize urgent cases, and reduce human error, ultimately increasing diagnostic precision and enhancing radiologists’ workflow efficiency.

Driving Personalized and Predictive Healthcare

AI-powered imaging systems are enabling a shift toward predictive and personalized healthcare. By integrating imaging data with electronic health records (EHR) and other patient data, AI can predict disease progression and recommend tailored treatment plans. This not only improves patient outcomes but also helps healthcare providers allocate resources more efficiently. Moreover, AI applications in image reconstruction and enhancement improve image quality while reducing scan times and radiation exposure, making diagnostic imaging safer and more accessible.

Medical Digital Imaging System Market Growth Factors

-

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic conditions such as cancer, cardiovascular disorders, and neurological diseases is fueling demand for advanced diagnostic tools, including digital imaging systems. Early and accurate diagnosis is essential for effective treatment, which drives the adoption of imaging technologies in hospitals and diagnostic centers. -

Technological Advancements in Imaging Modalities

Innovations in modalities such as MRI, CT, PET, and ultrasound, including the integration of AI and machine learning, are significantly improving image resolution, speed, and accuracy. These advancements make imaging systems more efficient and user-friendly, encouraging wider clinical usage. -

Growing Geriatric Population

With aging populations around the world, there is a higher demand for diagnostic procedures, as older individuals are more susceptible to chronic and degenerative diseases. This demographic trend is a major contributor to the sustained growth of the imaging market. -

Shift Toward Minimally Invasive Diagnostics

Non-invasive and minimally invasive diagnostic techniques are increasingly favored due to lower patient risk, shorter recovery times, and better patient compliance. Digital imaging systems provide critical support for these procedures, leading to their rising adoption. -

Expanding Healthcare Infrastructure in Emerging Markets

Emerging economies are investing heavily in healthcare infrastructure and diagnostic capabilities. Government initiatives, rising healthcare expenditure, and improved access to medical services are boosting the deployment of imaging technologies across regions like Asia Pacific, Latin America, and the Middle East. -

Increasing Use of AI and Cloud-Based Imaging Solutions

The integration of AI for automated analysis and cloud platforms for image storage and sharing is revolutionizing diagnostic workflows. These technologies improve accessibility, data management, and collaboration, fueling growth across hospitals, diagnostic centers, and telemedicine platforms.

Medical Digital Imaging System Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 67.38 Billion |

| Market Size in 2025 | USD 38.82 Billion |

| Market Size in 2024 | USD 36.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Modality, Deployment Mode, Application, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. |

Medical Digital Imaging System Market Dynamics

Market Drivers

Several factors are driving the growth of the medical digital imaging system market. These include rapid technological advancements in imaging modalities such as MRI, CT, ultrasound, and nuclear imaging. The growing adoption of AI and machine learning in diagnostic imaging is enabling faster image analysis and improved decision-making by healthcare professionals.

Increased healthcare spending, improved patient awareness, and government support for early disease detection programs are also significant contributors. Furthermore, the rising volume of diagnostic procedures and demand for real-time imaging is pushing healthcare providers to upgrade their imaging infrastructure.

Market Opportunities

Emerging markets present untapped growth opportunities for medical digital imaging systems due to rising healthcare investments and expanding access to medical services. The integration of AI with digital imaging opens new avenues for innovation, particularly in automated image analysis, predictive diagnostics, and personalized treatment planning.

Cloud-based imaging platforms and teleradiology are becoming increasingly popular, allowing remote diagnosis and consultation, especially in rural or underserved regions. The development of portable and point-of-care imaging devices is also enhancing market reach and improving patient outcomes in home healthcare and emergency care settings.

Market Challenges

Despite the growth potential, the market faces several challenges. High initial costs associated with advanced imaging equipment and maintenance can limit adoption, especially in resource-constrained settings. Interoperability issues between imaging systems and electronic health records (EHRs) can hinder workflow efficiency.

The lack of skilled professionals to operate and interpret complex imaging technologies also poses a significant barrier. Moreover, concerns regarding data privacy and cybersecurity in cloud-based and connected imaging systems must be addressed to ensure safe usage.

Regional Insights

North America remains the largest market for medical digital imaging systems, owing to its strong healthcare infrastructure, early adoption of new technologies, and favorable reimbursement policies. The United States leads the region with high diagnostic imaging utilization rates and ongoing R&D initiatives.

Meanwhile, Asia Pacific is expected to grow at the fastest rate, driven by increasing healthcare access, government initiatives to modernize healthcare systems, and a growing middle-class population. Countries like China and India are investing heavily in diagnostic infrastructure, creating strong demand for digital imaging solutions.

Recent Developments

- In March 2025, GE HealthCare announced a strategic collaboration with NVIDIA at GTC 2025, expanding the existing relationship between the two companies to focus on boosting innovation in autonomous imaging, beginning with autonomous X-ray technologies and autonomous applications within ultrasound.

- In August 2024, Bio-Rad Laboratories launched the ChemiDoc Go Imaging System, a cutting-edge addition to its ChemiDoc Imaging Systems portfolio. The system utilizes complementary metal oxide semiconductor (CMOS) digital imaging to acquire images with high sensitivity, comparable to larger instruments, on a benchtop scale. This results in rapid, reliable, and highly sensitive gel and western blot imaging.

- In August 2024, Siemens Healthineers collaborated with Mayapada Healthcare to implement a digital transformation initiative, enhancing patient-centric care through advanced medical imaging data management. The collaboration includes the deployment of Syngo Carbon Image & Data Management (Syngo Carbon IDM), integrating with Mayapada’s Hospital Information System (HIS) and Patient Portal to consolidate patient data into a single location, enabling secure & consolidated data access/management and to reduce data silos.

- In February 2024, Diagnostic imaging and multimedia company Visage Imaging launched Visage Ease VP, an immersive imaging platform that can be used on Apple’s augmented reality headset, Apple Vision Pro. Visage offers cloud-based, AI-enabled enterprise imaging software, including Visage 7, Visage Ease, and Visage Ease Pro, that allows users to examine diagnostic images and collaborate with colleagues. The company said that the new solution helps improve radiologists’ reading and workflow.

Medical Digital Imaging System Market Companies

- Siemens Healthineers

- Canon Medical Systems Corporation

- Koninklijke Philips N.V.

- Mindray Medical International

- MIM Software, Inc.

- DeepHealth

- Epic Systems Corporation

- FUJIFILM VisualSonics Inc.

- Carestream Health

- Hitachi

- Samsung Medison Co., Ltd.

Segments Covered in the Report

By Component

- Hardware

- Workstations

- Servers

- Storage Systems

- Software

- Picture Archiving and Communication Systems (PACS)

- Radiology Information Systems (RIS)

- Vendor Neutral Archives (VNA)

- Advanced Visualization Software

- AI/ML-based Tools for Image Analysis

- Services

By Modality

- X-ray

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Nuclear Imaging (PET/SPECT)

- Mammography

By Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid

By Application

- Diagnostic Imaging

- Therapeutic Imaging

- Research and Training

By End-use

- Hospitals

- Diagnostic Imaging Centers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Also Read: Enzyme Immunoassay Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Bladder Cancer Therapeutics Diagnostics Market Size to Attain USD 9.53 Billion by 2034 - April 14, 2025

- Scleral Lens Market Size to Gain USD 982.68 Bn by 2034 - April 11, 2025

- Water for Injection Market Size to Attain USD 87.39 Billion by 2034 - April 10, 2025