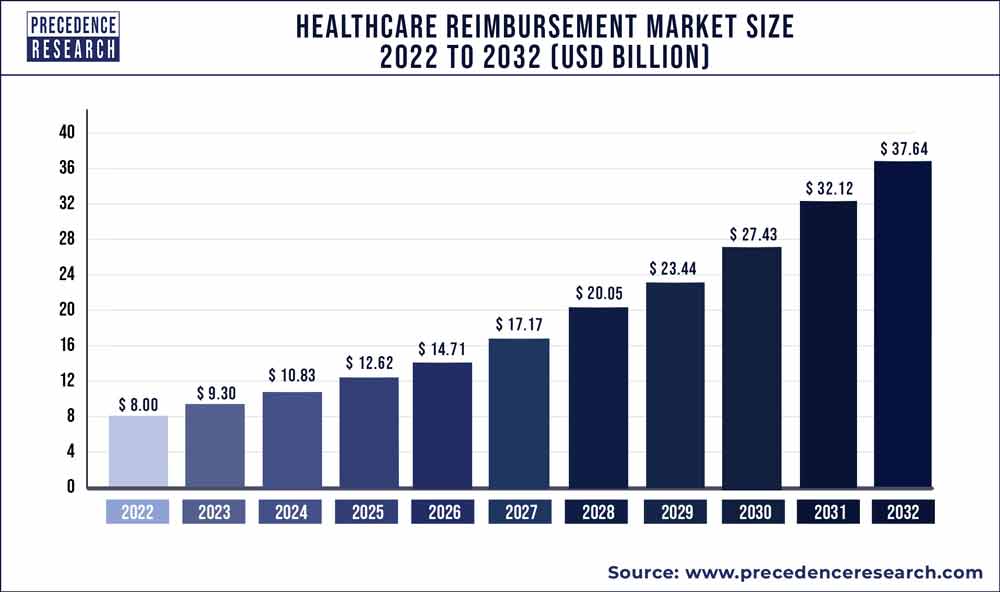

The global healthcare reimbursement market size was estimated at US$ 9.30 billion in 2023 and is expected to rake US$ 37.64 billion by 2032, poised to grow at a CAGR of 16.80% from 2023 to 2032.

Payment that clinics, diagnostic centers, medical doctors, and other medical care professionals receive for providing medical services to individuals is known as health-related reimbursement. Usually the cashless system is the optimum approach of processing claim and reimbursements. Throughout this, the covered by insurance patient goes to be able to the provider together with receives care. On discharge, the person walks out without paying any cash.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1586

Typically the bills and important documents are submitted to be able to the TPA who also reimburses the clinic. Later the TPA in that case submits the very same to the insurance firm (be it typically the organizer or typically the insurance company) who also then reimburses the TPA. However, the TPA and the insurance provider needs to be able to monitor the volumes closely, in order that exactly where the patient possesses exceeded their restrictions, the balance funds is recovered via the patient on the time involving discharge.

Report Highlights

- Private hospitals were the leading segment in the healthcare reimbursement market in 2020. This is mainly because of increasing geriatric populace along with increasing number of surgical procedures.

- Private payers segment dominated the global healthcare reimbursement market. Due to the presence of a high number of private companies in the market, they are expected to stay dominant during the projected period.

Report Scope of the Healthcare Reimbursement Market

| Report Coverage | Details |

| Market Size by 2032 | USD 37.64 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 16.80% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Claim, Payers, Service Provider, Geography |

Healthcare Reimbursement Market Dynamics

Driver

Increasing Demand for Insurance Policies Covering Entire Family Driving Market Growth

Although usage of telemedicine in the U.S. had already been least prior to COVID-19, interest in and application of telemedicine has broadened rapidly through the turmoil, as policymakers, health systems and insurance providers have looked for ways in order to deliver care to patients in their homes to limit transmitting of the story coronavirus. With growing with regard to telemedicine, several alteration have been made to telehealth coverage of entire family, coverage and setup, help to make telemedicine more highly accessible during the time of emergency.

Meanwhile, various commercial insurers have willingly addressed telemedicine in their reaction to Covid-19, concentrating on reducing or getting rid of cost sharing, increasing coverage of telemedicine and expanding in-network telemedicine providers. Well-being systems have swiftly adapted to put into action new telehealth programs or ramp upwards existing ones. This specific requires considerable financial and workforce investment, which may be more difficult for smaller or less-resourced practices.

Restraint

Fraudster Activities in Insurance Claims to Restraint Market Growth

There are several fraud activities through which consumers try to avail claims. Such activities include getting claims for items used for personal reasons; billing for travel and costs that never provided (canceled airline seat tickets, seminar or conference registration fees, college tuition reimbursement and professional dues payments), reimbursement for items that were never purchased (office items, gifts for clients). Such factors pose threats for the companies. To avoid these, companies can keep a record of a travel reimbursement guidelines and policies that control this activity. Need of original documentation to be either posted with the reviews or maintained for a time framework for audit purposes. Initiating elegant review process in which a division manager or comparative reviews employees’ reviews. Payroll or prospecting should perform a cursory review as well. Awaiting a bigger problem to create will only be more difficult and costly to resolve later.

Opportunities

Favorable reimbursement policies May Offer Promising Growth Opportunities.

Providing Ideal reimbursement policies will expand care distribution models beyond physical medicine to include behavioral health, digital wellness therapies, dental treatment, nutrition, and pharmaceutical drug management. The global aging population and an expanding midsection class are major contributors to the chronic disease pandemic and surging health care costs. This season will be a crucial year for identifying value for health care innovation and technology for digital health solutions catering to aged care and chronic conditions management to bending health care cost curve. Telemedicine in emerging marketplaces will become more mainstream and will seek to become a managed service provider rather than being simply a telemedicine system. In addition, telemedicine will turn towards the open public health space as well, with countries around the world like Singapore is testing the programs in a regulating sandbox.

Challenges

Reaching the poor consumers is the major challenge for the insurance companies mainly in the developing regions. The major task in the sustainable reimbursement design that would include poor consumers will be to identify the particular poor families. Along with some with particular interventions, the poor consumers’ lists can be refined to ensure that fake positives and fake negatives are reduced. More important, this kind of schemes should not really be reduced in order to populist measures. To become a sustainable design, such schemes must be functional for in long run with full security and then along with a tapering security over the following five years. By doing this, the people can have faith inside the insurance scheme and provider and consumers may even also get straight into the habit of having health insurance.

Read Also: Medical Nonwoven Disposables Market Size, Report, By 2032

Some of the major market players operating in the industry are as follows:

- UnitedHealth Group

- Aviva

- Allianz

- CVS Overall health

- BNP Paribas

- Aetna

- Nippon Life Insurance policies

- WellCare Health Ideas

- Agile Health Insurance

- Violet Cross Blue Cover Association.

Segments Covered in the Report

By Claim

- Fully Paid

- Underpaid

By Payers

- Private

- Public

By Service Provider

- Hospitals

- Diagnostic Labs

- Physician Office

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Esoteric Testing Market Size to Hit USD 75.54 Bn by 2032 - July 17, 2024

- mRNA Therapeutics Market Size to Surpass USD 39.99 Bn By 2033 - July 17, 2024

- Acne Treatment Market Size to Hit USD 15.86 Bn by 2033 - July 17, 2024