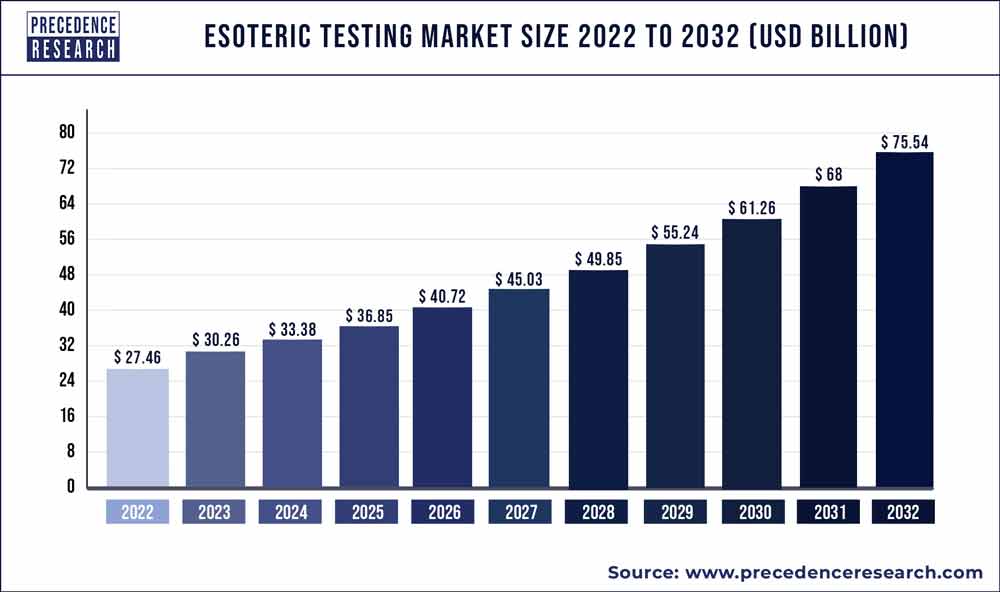

The global esoteric testing market size reached USD 30.26 billion in 2023 and is projected to surpass around USD 75.54 billion by 2032 with a CAGR of 10.70% from 2023 to 2032.

Examination of “unique” compounds or chemicals is referred to as exotic research. This is not a standard diagnostic medical procedure. These tests are carried out after additional details outside of regular laboratory tests are needed for an accurate diagnosis of a condition, to create a forecast, or to choose and oversee a therapy course of action. Because esoteric analysis uses complicated machines and equipment, competent professionals are needed to test the study hypotheses and analyse the data.

High price, the testing will be carried out by specialized and autonomous medical research facilities. It’s not practical for institutions and doctor’s offices to carry out these examinations throughout. The testing is governed by a restrictive legal environment. These examinations aren’t routinely carried out.

Get a Sample: https://www.precedenceresearch.com/sample/2019

Key Takeaways:

- North America region was highest revenue holder in 2022.

- Infectious disease testing segment contributed highest share 32% in 2022.

- Based on technology, the chemiluminescence immunoassay (CLIA) segment accounted highest share in 2022.

- By teste type, endocrinology segment held revenue share of 20% in 2022.

- By technology, ELISA segment was vaealthcarlued at USD 6.2 billion in 2022.

- North America esoteric testing market is expected to grow at a CAGR of 7% from 2023 to 2032.

What is the regional impact in the esoteric testing market?

Numerous industry expansion chances are available in Asian nations. Furthermore, the difficulty brought on by the insufficient payments may put a cap on how much the industry can expand. Depending on the kind, technique, end customer, and area, the specialized diagnostics industry is fragmented into subgroups. Due to the increasing frequency of degenerative illnesses, technical advances, and the expanding variety of screening procedures accessible, the exotic diagnostics market in this Region attained a significant share throughout 2020 but is anticipated to maintain its leading position over the projection timeframe.

However, the global Asia-Pacific segment is likely to grow just at the highest CAGR during 2021-2030, mostly because of an exacerbation of chronic illness, a development in governmental testing projects, and a boost in public attention of consciousness.

Report Highlights:

- Rising geriatric, rise in chronically and contagious illness incidence, development of specialized Genetic sequence analysis in personalized medicine, rapid disease detection, and targeted therapy. In 2021, the specialized screening industry has been dominated by tests for contagious diseases.

- Even during the anticipated timeframe, the fluorescent dye assay retained the number one position for specialized diagnostics.

- In 2021, the esoteric testing market’s largest regional market was North America. The general environment of the esoteric testing sector will benefit from the rising need for enhanced proteomics and genomics. The esoteric testing sector will have unprecedented growth potential thanks to the high specificity of specialist tests in the diagnosis of infectious diseases.

- The rise of the industry in North America will be aided by sophisticated healthcare infrastructure that can accommodate the need for specialty esoteric testing. The esoteric testing industry is expanding as a result of technological developments in esoteric testing and an increase in the number of diagnostic tests.

- However, it is anticipated that the market growth will be constrained over the forecast period due to the high cost of esoteric testing and a shortage of competent specialists.

Report Scope of the Esoteric Testing Market

| Report Coverage | Details |

| Market Size in 2023 | USD 30.26 Billion |

| Market Size by 2032 | USD 75.54 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 10.70% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Type, Technology, End User, Geography |

Esoteric Testing Market Dynamics:

Drivers:

Aging of the population, rise in persistent and contagious illness occurrence, development of exotic Genetic sequencing methods in targeted therapy, early tumor screening, and targeted therapies Globally, infectious illnesses including diabetes, heart failure, and malignancy are now on the increase. Communicable disease occurrence is also rising significantly and includes diseases like Hepatitis B, Malaria, Dengue, Aids, Tb, and many others. The knowledge of exotic testing for the quick and accurate detection of certain disorders is growing. Esoteric tests’ improving technologies have provided faster performance with better accuracy, the limit of quantification, and effectiveness. This market has been growing as just a result of the rising utilization of esoteric Genetic analysis, generation sequencing methods, and whole functional genomics for the detection of cancer, targeted therapy, and personalized medicine. In addition to improving lifespan and the frequency and effects of chronic conditions, new DNA fingerprinting techniques are being developed for targeted therapy, early tumor detection, and targeted therapy.

Restraints:

One of the main factors limiting the expansion of the exotic diagnostic business is insufficient compensation. Private insurers’ reimbursement of personalized and healing practices is quite limited. The amount of testing has already been significantly influenced in recent years by a decrease in the reimbursements for screening procedures. This led to the formation of Health care, Insurance, as well as other payers, notably healthcare insurance organizations, tightening their restrictions on the use of clinical laboratories (MCOs).

Opportunities:

Technological innovations including recent research morphological characteristics techniques, pyrosequencing, digitized PCR, Genotyping, or Genome sequence, as well as diagnostic research are anticipated to drive the economy’s expansion. Main competitors in the exotic diagnostics market can anticipate prospective future growth from the growing markets like China, India, and others. This could be due to the rising older population, with a frequency range of parasitic infections, the development of the medical system, and rising disposable cash within those nations.

The industry is estimated to propel by a variety of technological advancements, including digital PCR, genomic analysis, Pyrosequencing, next-generation sequencing, capillary systems, and enhanced genetic morphological characteristics innovations. Market participants in the specialized screening sector can take advantage of the chances provided by developing nations like China, India, and technological India.

Challenges:

Since there is a shortage of trained workers, the labor force is aging, and also the number of people enrolling in educational programs is decreasing. Clinical and laboratory specialists learn these skills after around 5 – 10 years of consistent practice. Hidden therapeutic laboratory studies are much more sophisticated than molecular biological assays.

Read Also: mRNA Therapeutics Market Size to Surpass USD 39.99 Bn By 2033

Key market developments:

- The autoimmunity operations segment of Myriad Genomics would be purchased by Labcorp, in May 2021.

- Quest Laboratories and GRAIL partnered to develop Galleri, a ground-breaking complete blood count for the early diagnosis of several cancers In Feb 2021.

- In the US, OPKO Healthcare Inc. (In addition to its core Laboratory) introduced Scarlett Healthcare in Jan 2021, a seamlessly engaged in-home testing platform.

- H.U., in Mar 2019, Tokyo Chugai Pharma. and sourced from local Enterprises, a division of Group Acquired, collaborated.

- ARUP Laboratory and PacBio confirmed their participation in research to boost the identification of uncommon diseases in Nov 2021, these have given the firm the ability to find cutting-edge paramount in ensuring and presenting corporate development opportunities.

- Fulgent Genomics, Inc. reported in Aug 2021 that it will purchase CSI Laboratory to expand cellular molecular biology techniques and tumor detection. The business scope of the company has benefited from this transaction.

Key market players:

- ACM Global Laboratories (US)

- ARUP Laboratories (US).

- Baylor Esoteric and Molecular Laboratory (US)

- BioAgilytix Labs (US)

- BP Diagnostic Centre SDN BHD (Malaysia)

- BUHLMANN Diagnostics Corp (BDC, US)

- Cerba Xpert (Belgium)

- Eurofins Scientific (Luxembourg)

- Flow Health (US)

- Foundation Medicine (US)

- Georgia Esoteric & Molecular Laboratory, LLC (US)

- H.U. Group Holdings, Inc. (Japan)

- Helius Limited (Australia)

- HealthQuest Esoterics (US)

- Kind star Global (Beijing) Technology, Inc. (China)

- Labcorp (US)

- Leo Labs, Inc. (India).

- Mayo Foundation for Medical Education and Research (US)

- National Medical Services Inc. (NMS) (US)

- OPKO Health (US).

- Quest Diagnostics (US

- Sonic Healthcare Limited (US)

- Stanford Clinical Pathology (US)

- Thyrocare Technologies Ltd. (India)

Segments are covered in the report:

By Type

- Infectious Diseases Testing

- Endocrinology Testing

- Oncology Testing

- Genetics Testing

- Toxicology Testing

- Immunology Testing

- Neurology Testing

- Other Testing

By Technology

- Chemiluminescence Immunoassay

- Enzyme-Linked Immunosorbent Assay

- Mass Spectrometry

- Real-Time PCR

- DNA Sequencing

- Flow Cytometry

- Other Technologies

By End User

- Independent & Reference Laboratories

- Hospital-Based Laboratories

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Esoteric Testing Market Size to Hit USD 75.54 Bn by 2032 - July 17, 2024

- mRNA Therapeutics Market Size to Surpass USD 39.99 Bn By 2033 - July 17, 2024

- Acne Treatment Market Size to Hit USD 15.86 Bn by 2033 - July 17, 2024