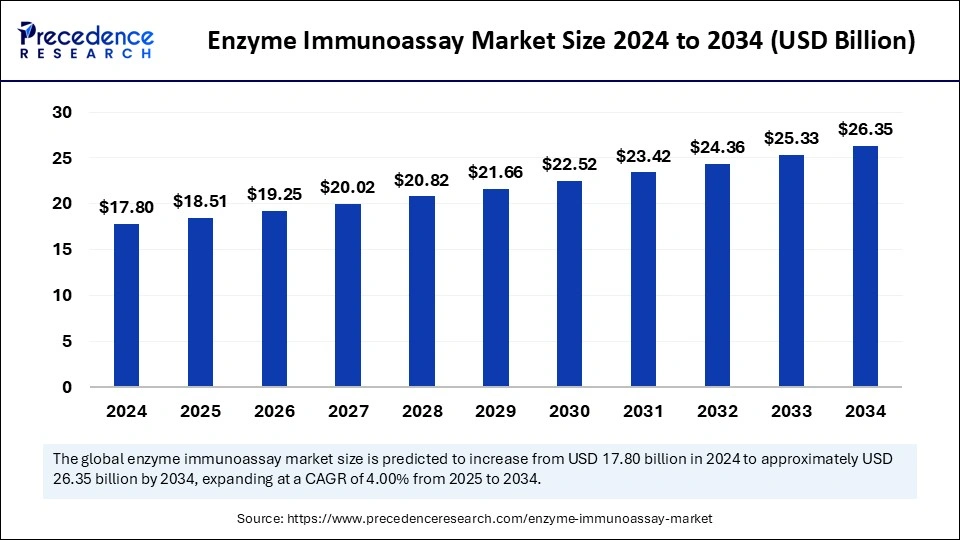

The global enzyme immunoassay market size was valued at USD 17.80 billion in 2024 and is expected to attain around USD 26.35 billion by 2034, growing at a CAGR of 4.00% from 2025 to 2034.

Enzyme Immunoassay Market Key Insights

-

North America accounted for 68% of the global market in 2024.

-

Asia Pacific is expected to expand at a CAGR of 6.64% during the study period.

-

Reagents and kits were the most widely used product type.

-

Software and services will likely see notable CAGR growth going forward.

-

Blood sample analysis was the dominant practice by specimen type.

-

Urine sample testing is projected to increase at the fastest pace.

-

Infectious disease testing stood as the top application in the market.

-

Oncology testing is forecasted to emerge as a rapidly growing segment.

-

Hospitals were the primary end-users in 2024.

-

Clinical labs are predicted to be the fastest-growing end-use segment.

Role of AI in the Enzyme Immunoassay (EIA) Market

Artificial Intelligence is playing a transformative role in the enzyme immunoassay market by improving the accuracy, speed, and efficiency of diagnostic processes. AI-powered image recognition and data analysis algorithms can analyze EIA results more precisely, reducing the chances of human error and enabling early detection of diseases. These tools can interpret colorimetric changes, automate result interpretation, and even flag anomalies that may be missed by manual reading.

Moreover, AI facilitates real-time monitoring, predictive diagnostics, and advanced decision support by integrating EIA platforms with electronic health records (EHRs). Machine learning models can also help identify patterns in immunoassay data that contribute to more accurate diagnostics, disease tracking, and personalized treatment plans. As the demand for high-throughput and point-of-care testing increases, AI integration is becoming vital in enhancing lab workflows, optimizing reagent use, and ensuring better patient outcomes.

Enzyme Immunoassay Market Growth Factors

-

Rising Prevalence of Infectious and Chronic Diseases

The growing incidence of infectious diseases like HIV, hepatitis, and COVID-19, along with chronic conditions such as cancer and diabetes, has significantly increased the demand for enzyme immunoassays for accurate and early diagnosis. -

Advancements in EIA Technology

Continuous innovations in assay formats, automation, sensitivity, and detection methods are enhancing the reliability and efficiency of EIAs, making them more accessible for clinical diagnostics and research applications. -

Increased Adoption of Point-of-Care Testing

The rising need for rapid, user-friendly, and accurate diagnostic tools has led to the widespread use of EIA in point-of-care settings, especially in developing regions with limited healthcare infrastructure. -

Supportive Government Initiatives and Funding

Governments and healthcare organizations are investing in early disease detection and management programs, which is boosting demand for efficient diagnostic techniques like enzyme immunoassays. -

Growth of Personalized Medicine

The shift toward personalized healthcare is creating opportunities for EIAs to be used in patient-specific testing, including biomarker detection and monitoring of therapeutic responses. -

Rising Use in Drug Testing and Food Safety

Beyond healthcare, EIA is increasingly used in industries such as pharmaceuticals, food safety, and environmental testing, contributing to overall market expansion. -

Automation and Integration with AI

The integration of AI and robotics into EIA platforms is enabling high-throughput testing, reducing manual errors, and speeding up diagnostics, which supports market growth further.

What is Enzyme Immunoassay (EIA)?

Enzyme Immunoassay (EIA), also known as Enzyme-Linked Immunosorbent Assay (ELISA), is a biochemical technique used to detect the presence of specific antigens or antibodies in a sample through enzyme-labeled reagents. It is widely used in clinical diagnostics, biomedical research, and quality control across industries like pharmaceuticals and food safety.

How It Works

EIA involves attaching an antigen or antibody to a solid surface (usually a microplate), adding an enzyme-linked detection antibody, and then applying a substrate. A measurable signal (often a color change) indicates the presence and quantity of the target molecule.

Key Applications

-

Clinical Diagnostics: Used for detecting infections (e.g., HIV, hepatitis), hormone levels, and autoimmune diseases.

-

Food Safety: Detects contaminants, allergens, and pathogens.

-

Pharmaceuticals: Used in drug screening and therapeutic monitoring.

-

Environmental Testing: Identifies toxins and pollutants in water and soil.

Advantages

-

High sensitivity and specificity

-

Cost-effective and scalable

-

Suitable for both qualitative and quantitative analysis

-

Can be automated for high-throughput testing

Types of EIA

-

Direct EIA: Detects antigens using a single labeled antibody.

-

Indirect EIA: Uses a primary and a labeled secondary antibody.

-

Sandwich EIA: Captures antigen between two antibodies for higher specificity.

-

Competitive EIA: Measures antigen concentration based on signal inhibition.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5792

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 26.35 Billion |

| Market Size in 2025 | USD 18.51 Billion |

| Market Size in 2024 | USD 17.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.00% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Specimen , Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The expanding base of patients with communicable and lifestyle-related diseases is a major driver. In addition, the growing awareness about preventive healthcare and the role of immunoassays in vaccine development are fueling market expansion.

Opportunities

The rise of telemedicine and digital health solutions opens new doors for EIA-based remote diagnostic kits. Moreover, the increasing focus on personalized medicine enhances the value of immunoassays in tracking biomarkers and individual responses to therapies.

Challenges

Limitations in standardization, especially across different brands and testing platforms, pose significant hurdles. Delays in regulatory approvals and supply chain issues also impact the global availability of immunoassay kits.

Regional Insights

Europe holds a strong market presence due to its emphasis on quality diagnostics and public health initiatives. However, Latin America and Africa are projected to show strong potential as healthcare systems in these regions modernize and invest in lab diagnostics.

Enzyme Immunoassay Market Companies

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- bioMérieux SA

- QuidelOrtho Corporation

- Sysmex Corporation

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

- Becton, Dickinson and Company

- Thermo Fisher Scientific, Inc.

Leaders Announcements

- In November 2023, Sysmex and Fujirebio broadened their contract development collaboration to address neurodegenerative diseases, concentrating on creating reagents for the HISCL-Series automated immunoassay system of Sysmex to enhance diagnostics for Alzheimer’s disease.

- In February 2024, Labcorp and Roche Diagnostics joined forces to introduce the Elecsys enzyme immunoassay platform of Roche, leading to better automation, broader test options for oncology, infectious diseases, and cardiac biomarkers, along with improved diagnostic precision.

- In June 2024, Fujirebio and Agape Diagnostics formed a partnership to create cartridge-based chemiluminescence immunoassay system reagents, which are scheduled to be launched, providing more than 30 diagnostic parameters spanning medical fields such as oncology and infectious diseases.

Recent Developments

- In November 2023, Neogen launched the Veratox® VIP assay, a precise quantitative ELISA test for identifying walnut allergens. It delivers a strong performance for various sample types and gives results in 30 minutes.

- In July 2023, Anbio Biotechnology Limited introduced the AF-100S FIA Solution, a portable analyzer for point-of-care immunodiagnostics, showcasing swift diagnostic solutions and ease of use in healthcare settings.

- In July 2023, Roche Diagnostics India launched the Elecsys® HCV Duo, the first fully automated immunoassay in India capable of detecting both antigen and antibody status from a single plasma or serum sample, facilitating earlier diagnosis and disease prevention.

Segments Covered in the Report

By Product

- Reagents and Kits

- Analyzers/Instruments

- Software and Services

By Specimen

- Blood

- Saliva

- Urine

- Other Specimens

By Application

- Therapeutic Drug Monitoring

- Oncology

- Cardiology

- Endocrinology

- Infectious Disease Testing

- Autoimmune Diseases

- Others

By End-Use

- Hospitals

- Blood Banks

- Clinical Laboratories

- Pharmaceutical and Biotech Companies

- Academic Research Centers

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Pharmaceutical CDMO for Formulations Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Leukemia Inhibitory Factor (LIF) Market Size to Attain USD 2.90 Bn by 2034 - April 16, 2025

- Intravenous Infusion Pump Market Size to Attain USD 13.80 Bn by 2034 - April 16, 2025

- Surgical Sponge Market Size to Attain USD 4.41 Billion by 2034 - April 15, 2025