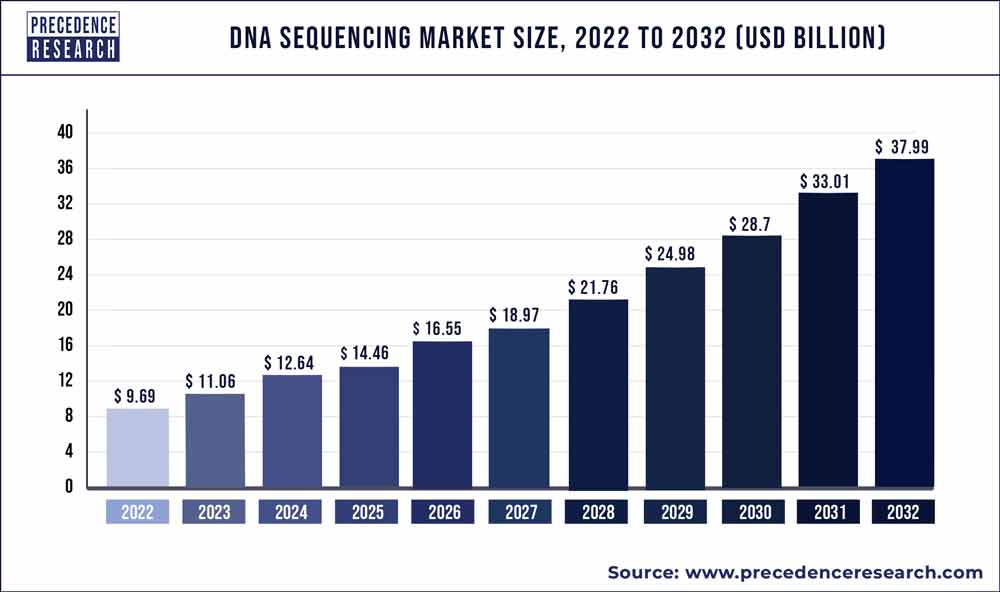

The global DNA sequencing market size is projected to hit around US$ 37.99 billion by 2032, with a CAGR of 14.7% from 2023 to 2032.

Key Takeaways

- North America led the global market with the highest market share in 2022.

- By Product, the Consumables segment has held the largest market share in 2022.

- By Technology, the next-generation sequencing segment captured the biggest revenue share in 2022.

- By Application, the Oncology segment captured the biggest revenue share in 2022.

- By End-Use, the Academic Research segment is estimated to hold the highest market share in 2022.

DNA sequencing is a procedure used to ascertain the nucleotide sequence of DNA (deoxyribonucleic acid). The nucleotide sequence is a blueprint that encompasses the directives for building an organism, and no perception of the genetic function or progression can be complete without gaining this data. The nucleotide sequence is thus an essential level of information of a genome or gene. Sequencing a complete genome is a complex task that requires separating the DNA of the genome into numerous smaller fragments, sequencing the fragments, and gathering the sequences into a sole long consensus.

The early methods of sequencing (also known as first-generation sequencing technologies) were developed in the 1970s which included Maxam-Gilbert and Sanger method. However, next-generation sequencing methods have mostly supplanted the first-generation methods. These newer methods enable numerous DNA fragments (occasionally on the order of millions of strands) to be sequenced at one time and are more cost-effective and much quicker than first-generation methods. The efficacy of next-generation methods was enhanced significantly by advances in the field of bioinformatics that allowed for augmented data storage and helped the analysis and handling of very big data sets.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1189

What are the market growth factors?

Factors such as constant technological advancements in the sequencing methods, developments in the field of bioinformatics, increasing applications of NGS (Next-generation Sequencing) and WGS (Whole-genome Sequencing), growing prevalence of viral diseases such as SARS and COVID-19, increasing cases of cancer globally, and growing research and development expenditure are propelling the DNA sequencing market expansion across the globe. Additional aspects that are anticipated to fuel this industry are applications in cancer research, biomarker discovery, personalized medicine, genomic analysis, and forensics. Constant collaborations and partnerships between major market players in order to launch new and innovative technologies have enhanced the demand for overall market for the DNA sequencing market.

DNA sequencing also has applications in the field of animal and plant breeding. Selecting the finest animals for next generation breeding is needs an in-depth understanding of the livestock genetics. Genomics technologies are entirely established in breeding and are becoming further competent due to technology innovations and progresses. The area of modern farming has instituted techniques such as genome sequencing, genome wide association, genotyping, and genetic markers. Moreover, genome sequencing has reached satisfactory success in beef cattle and milk cow breeding with enhanced properties in characters such as milk yield, beef quality, feed efficiency, and health.

Report Scope of the DNA Sequencing Market

| Report Highlights | Details |

| Growth Rate from 2023 to 2032 | CAGR of 14.7% |

| Market Size in 2023 | USD 11.06 billion |

| Market Size by 2032 | USD 37.99 billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, technology, Application, End Use |

Report Highlights:

- Among the product segment, consumables are expected to dominate the overall market. High requirement for consumables such as reagents and kits for DNA fragmentation and amplification is the major reason for high market share of consumables.

- The next-generation sequencing accounted for the largest revenue in the technology segment with more than 52% share in 2020. Factors such as tremendous advances in NGS technologies along with reduction in cost drive the growth if next-generation sequencing technologies.

- Oncology accounted for the largest revenue in the application segment. High prevalence of cancer in developing regions is the key reason for high market share of oncology.

- Academic research centers accounted for the largest revenue in the end-use segment. High investment in research and development is the key reason for high market share of academic research centers.

- Illumina, Inc. accounted for a significant share of the global DNA sequencing market.

Regional Analysis:

The report covers data for North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. In 2020, North America dominated the global market with a market share of more than 42%. U.S. represented the highest share in the North American region primarily due to presence of leading market players and high awareness regarding next-generation sequencing technologies. Furthermore, early adoption of latest sequencing technologies also contributed to the high market share of the United States.

Europe was the second important market chiefly due to high investment in research and development and presence of skilled researchers. High incidence of cancer in the European region is also expected to boost the demand for DNA Sequencing market in the near future. Asia Pacific is anticipated to grow at the maximum CAGR of around14% in the forecast period due to high incidence of viral disorders. Latin America and the African and Middle Eastern region will display noticeable growth.

Key Market Players and Strategies:

The major companies operating in the worldwide DNA sequencing are Agilent Technologies, Illumina, Inc., QIAGEN, Perkin Elmer, Thermo Fisher, Roche, Macrogen, Inc., Bio-Rad Laboratories, Inc., Oxford Nanopore Technologies, and Myriad Genetics among others.

High investment in the research and development along with acquisition, mergers, and collaborations are the key strategies undertaken by companies operating in the global DNA Sequencing market. Recently, researchers at the University of Birmingham developed a COVID-19 test that lessens testing duration from 30 minutes to less than 5 minutes, and exhibits accurate results. This method employs a DNA sequence (termed Binder DNA) that identifies and binds to SARS-CoV-2 viral RNA along with an enzyme (BstNI) that identifies the Binder DNA, and slashes a short section from it if viral RNA exists.

Read Also: Enteral Feeding Devices Market Size Attain US$ 5.84 Bn by 2032

Top Players contending in the Market:

- Agilent Technologies

- Illumina, Inc.

- QIAGEN

- Perkin Elmer

- Thermo Fisher Scientific

- Hoffmann-La Roche Ltd.

- Macrogen, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies Ltd.

- Myriad Genetics

Major Market Segments Covered:

By Product

- Instruments

- Consumables

- Services

By Technology

- Third Generation DNA Sequencing

- Next-Generation Sequencing

- Sanger Sequencing

By Application

- Clinical Investigation

- Oncology

- Forensics & Agrigenomics

- Reproductive Health

- HLA Typing

- Others

By End-Use

- Clinical Research

- Academic Research

- Biotechnology & Pharmaceutical Companies

- Hospitals & Clinics

- Others

By Geography

-

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- North America

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/