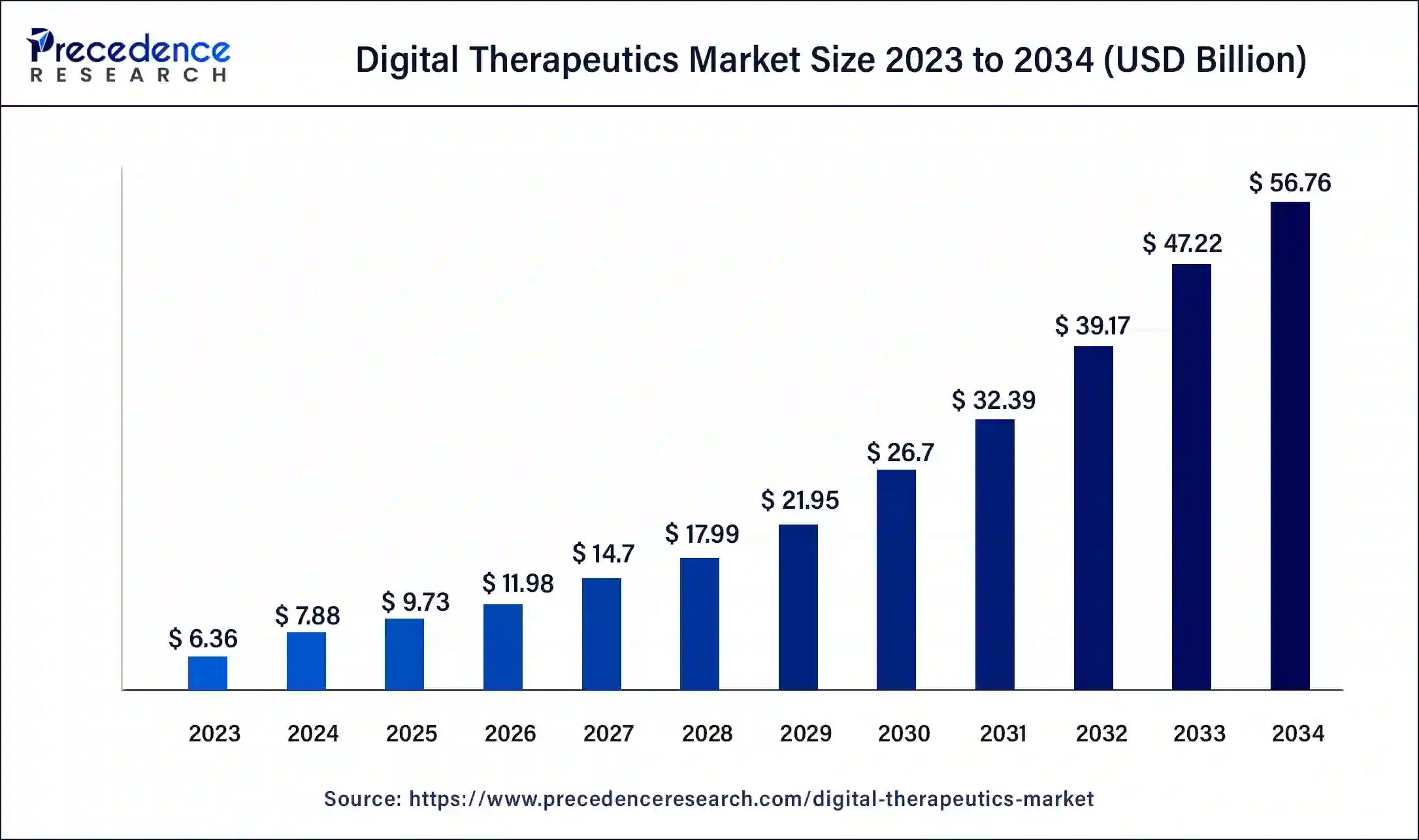

The global digital therapeutics market is calculated at USD 7.88 billion in 2024 and is expected to surpass around USD 56.76 billion by 2034, at a CAGR of 21.83%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1128

Key Points

- In 2023, North America emerged as the top market contributor with a 44.03% share.

- The devices category was the most significant product segment, commanding 87.38% of the market.

- The B2B sales channel outperformed others, securing a 65.29% share.

- The diabetes application was the leading segment by application, accounting for 26.46%.

Market Scope

| Report Scope | Details |

| Market Size in 2023 | USD 6.36 Billion |

| Market Size in 2024 | USD 7.88 Billion |

| Market Size by 2034 | USD 56.76 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 21.83% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Application, and By Sales Channel |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read Also:https://www.pharma-geek.com/stem-cells-market-size/

Market Dynamics

Market Drivers

The growth of the digital therapeutics market is primarily driven by the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and mental health conditions. Increasing awareness about digital health solutions and the growing adoption of mobile health applications are further fueling market expansion.

Technological advancements in artificial intelligence, machine learning, and big data analytics are enhancing the effectiveness of digital therapeutics. Additionally, supportive government initiatives and regulatory approvals are encouraging the integration of digital therapeutics into mainstream healthcare.

Opportunities

The increasing penetration of smartphones and the internet has created a vast opportunity for digital therapeutics companies to expand their reach. The growing demand for personalized medicine and remote patient monitoring is driving innovation in the sector.

Partnerships between technology firms and healthcare providers are also opening new avenues for market growth. Furthermore, the integration of digital therapeutics with wearable devices and telemedicine platforms is expected to provide significant opportunities for market expansion in the coming years.

Challenges

Despite the promising growth, the digital therapeutics market faces several challenges, including regulatory hurdles and compliance issues. Data privacy and security concerns remain major obstacles, as digital therapeutics rely on sensitive patient information.

Limited awareness among healthcare professionals and patients about the benefits of digital therapeutics also hinders market adoption. Additionally, reimbursement policies for digital therapeutics solutions vary across regions, making it difficult for companies to achieve widespread adoption.

Regional Insights

North America dominates the digital therapeutics market due to its advanced healthcare infrastructure, strong regulatory support, and high adoption of digital health solutions. Europe is also witnessing steady growth, driven by increased government funding and favorable reimbursement policies.

The Asia-Pacific region is expected to experience the fastest growth due to the rising burden of chronic diseases, increasing smartphone penetration, and growing investments in digital health technologies. Latin America and the Middle East & Africa are gradually adopting digital therapeutics, but challenges such as inadequate healthcare infrastructure and limited digital literacy continue to impede growth in these regions.

Digital Therapeutics Market Companies

- Fitbit Health Solutions

- 2MORROW, Inc.

- Medtronic Plc.

- Livongo Health, Inc.

- Pear Therapeutics, Inc.

- Omada Health, Inc.

- Resmed, Inc. (Propeller Health)

- Proteus Digital Health, Inc.

- Welldoc, Inc.

- Voluntis, Inc.

- Canary Health Inc.

- Noom, Inc.

- Mango Health Inc.

- Dthera Sciences

Recent Developments

- In September 2023, Fitbit introduced Fitbit Charge 6 to track heart rate during workouts.

- In September 2023, 2Morrow and FIT HR entered into a partnership to bring evidence-based digital wellness solutions to more than 120 local and national small to midsize organizations.

Segments Covered in the Report

By Product

- Device

- Software

By Sales Channel

- Business-to-Consumer (B2C)

- Caregiver

- Patient

- Business-to-Business (B2B)

- Healthcare Provider

- Employer

- Others

By Application

- Obesity

- Diabetes

- Central Nervous System (CNS) Disease

- Gastrointestinal Disorder (GID)

- Cardiovascular Disease (CVD)

- Smoking Cessation

- Respiratory Disease

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- MEA

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Leukemia Inhibitory Factor (LIF) Market Size to Attain USD 2.90 Bn by 2034 - April 16, 2025

- Intravenous Infusion Pump Market Size to Attain USD 13.80 Bn by 2034 - April 16, 2025

- Surgical Sponge Market Size to Attain USD 4.41 Billion by 2034 - April 15, 2025