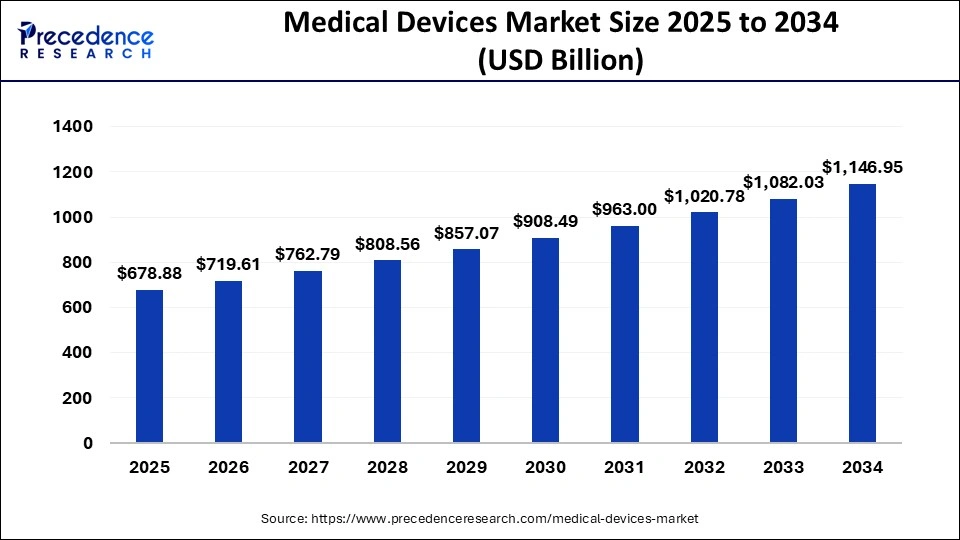

The global medical devices market size accounted for USD 640.45 billion in 2024 and is expected to cross around USD 1,146.95 billion by 2034, at a CAGR of 6%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1129

Key Points

- With a 40% share of total revenue, North America remained the leading regional market in 2024.

- Hospitals and clinics accounted for the largest share in the end-user segment.

- The diagnostics centers segment is anticipated to witness the highest CAGR between 2025 and 2034.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 640.45 Billion |

| Market Size in 2025 | USD 678.88 Billion |

| Market Size by 2034 | USD 1,146.95 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Therapeutic Application, End User, Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Also Read: https://www.pharma-geek.com/digital-therapeutics-market-size/

Market Drivers

The growing burden of chronic diseases, including cardiovascular disorders, diabetes, and respiratory illnesses, is a major factor driving the medical devices market. Increased awareness and demand for early disease diagnosis are pushing healthcare providers to adopt cutting-edge medical technologies.

The continuous evolution of smart medical devices and real-time monitoring systems is improving patient care outcomes. Additionally, government support for medical research and innovation is contributing to market growth.

Opportunities

Advancements in 3D printing, nanotechnology, and artificial intelligence are opening new doors for the medical devices market. The increasing popularity of point-of-care testing and self-diagnostic tools is driving demand for portable and user-friendly medical devices.

The rise of emerging markets with improving healthcare infrastructure provides significant opportunities for market expansion. Moreover, the shift towards digital health solutions, including AI-powered diagnostics and cloud-based patient monitoring, is expected to shape the future of medical devices.

Challenges

The stringent regulatory landscape remains a critical challenge for medical device manufacturers, as obtaining approvals involves time-consuming and expensive procedures. The growing risk of cyber threats in connected medical devices raises concerns over patient data security.

Market players also face pricing pressure due to competitive pricing and cost-containment measures implemented by healthcare providers. Additionally, disruptions in the global supply chain and fluctuations in raw material prices can hinder the production and distribution of medical devices.

Regional Insights

North America continues to dominate the global medical devices market, backed by strong research capabilities and a high adoption rate of advanced medical technologies. Europe follows closely, with increasing government initiatives to promote digital healthcare solutions.

The Asia-Pacific region is expected to witness the fastest growth, supported by rising healthcare expenditure, expanding hospital networks, and growing medical tourism. Latin America and the Middle East & Africa are progressing steadily, but challenges such as lower access to cutting-edge technology and inadequate healthcare funding remain.

Medical Devices Market Companies

- DePuy Synthes

- Medtronics Plc

- Fesenius Medical Care

- GE Healthcare

- Philips Healthcare

- Ethicon LLC

- Siemens Healthineers

- Stryker

- Cardinal Health

- Baxter International Inc.

- BD

Companies Share Insights

The global medical devices market is highly fragmented owing to the presence of large number of market players on global as well as regional level. Among these companies, Medtronic capture the largest market share with diverse product portfolio and strong brand name in the global market. Apart from this, most of the industry players invest prominently in the Research & Development (R&D) activity to develop new products and upgrade the existing product list. Furthermore, these market players largely focus on expanding their distributors across the globe that allows companies to expand their product offerings.

Recent Developments

- In November 2024, Beurer India Pvt. Ltd. introduced the GL 22 Blood Glucose Monitor. This innovative and user-friendly glucose monitoring solution manufactured under Beurer’s “Make in India” initiative. The device features comprehensive monitoring capabilities, offering crucial insights into blood glucose levels.

- In May 2024, OMRON Healthcare India collaborated with AliveCor India to launch AI-driven handheld ECG monitoring devices. These devices instantly detect various arrhythmias, including atrial fibrillation (Afib), bradycardia, and tachycardia.

Segments Covered in the Report

By Type

- Diagnostic Imaging

- Orthopedic Devices

- Cardiovascular Devices

- Minimally Invasive Surgical (MIS)

- Wound Management

- Diabetes Care

- Ophthalmic Devices

- General Surgery

- Dental Devicess

- In Vitro Diagnostics (IVD)

- Others

By End-user

- Hospitals & Ambulatory Surgery Centers (ASCs)

- Clinics

- Others

By Geography

- North America

- Asia Pacific

- Latin America

- Europe

- Middle East and Africa (MEA)

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Wearable Medical Devices Market Size to Hit USD 427.05 billion by 2034 - March 13, 2025

- In Vitro Diagnostics Market Size to Surge USD 132.18 Billion by 2034 - March 13, 2025

- Medical Devices Market Size to Cross USD 1,146.95 billion by 2034 - March 13, 2025