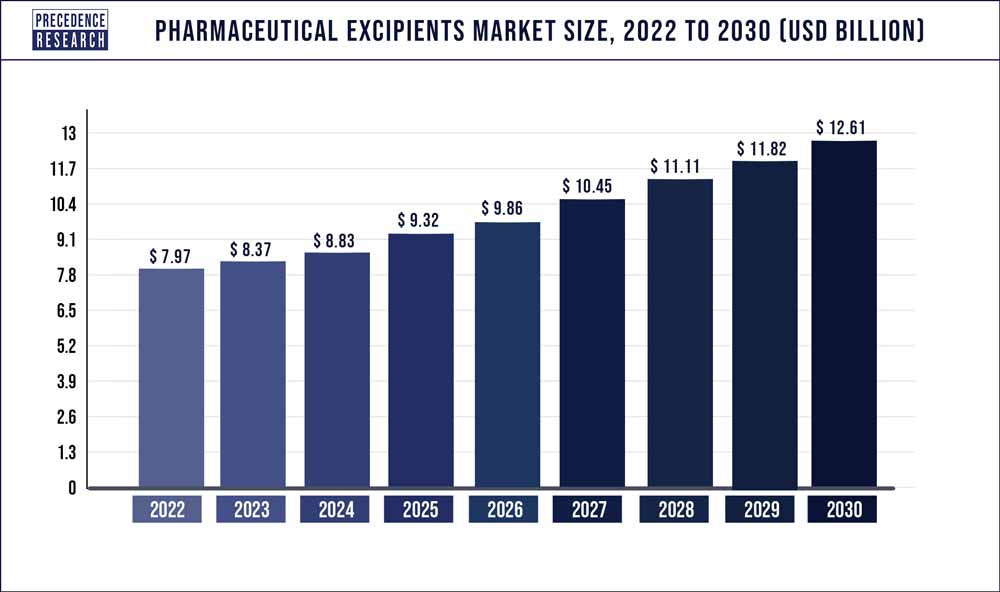

The global pharmaceutical excipients market size is projected to hit around US$ 12.61 billion by 2030, registering a CAGR of 5.9% from 2023 to 2030.

The demand for the oral formulations drugs has been witnessing a rapid increase from the past few years. This is attributable to the ease of consumption of these oral drug by the patient, especially children. Oral dosage formats usually require more amounts of excipients over other available drugs forms during the manufacturing process and is being promoted owing to the rising adoption of patient-centricity approaches by drug manufacturers globally.

Get the Sample Pages of Report@ https://www.precedenceresearch.com/sample/1761

For instance, approximately 50% of the patients across the world find it difficult to swallow conventional hard solid tablets. This has encouraged drug companies to come up with more innovative oral drug forms such as effervescent tablets, lozenges, instant drinks, orally disintegrating granules (ODGs), and chewable tablets. This is likely to offer immense opportunities for the increase in demand for excipients in the near future ultimately contributing in fueling the growth of the overall market in terms of value sales.

Regional Snapshot

Europe dominated the pharmaceutical excipient market share in the year 2020, the growing government initiatives for reducing the prices of the drugs along with the rising investments for the development of biologics as well as advanced dosage forms, is increasing the demand for new excipients and thereby contributing in the growth of the pharmaceutical excipients market in Europe. However, Asia-Pacific is predicted to grow at the high growth rate during the forecast period, owing to low cost of raw materials and availability of cost-effective workforce in this region. Moreover, the proliferation of pharmaceutical industry in countries like China, India and others is likely to offer immense opportunities for the growth of the market during the forecast period in terms of value sales.

Report Highlights

- On the basis of product, the organic chemical segment holds the largest market share in the global market and is anticipated to retain its dominance during the forecast period.

- On the basis of functionality, fillers & diluents segment holds the highest market share in the global market.

- On the basis of formulation, oral formulation segment holds the largest market share in the global market and is anticipated to retain its dominance during the forecast period.

- By region, Europe holds the largest market share in the global pharmaceutical excipients market. However, Asia-Pacific is expected to be the fastest growing market for the pharmaceutical excipients.

Report Scope of the Pharmaceutical Excipients Market

| Report Coverage | Details |

| Market Size in 2023 | USD 8.37 Billion |

| Market Size by 2030 | USD 12.61 Billion |

| Growth Rate from 2023 to 2030 | CAGR of 5.9% |

| Largest Market | North America |

| Fastest Growing Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2030 |

| Segments Covered | Product, Functionality, Formulations, End-Users, Distribution Channel, Geography |

Pharmaceutical Excipients Market Dynamics

Drivers

Growing requirement for biopharmaceuticals to augment market growth

Biopharmaceuticals are progressively becoming popular in the pharmaceutical industry owing to its similarity with the natural biological compound that is found in the body and have high potency and lesser side-effects. Thus, biopharmaceuticals form is one of the fastest growing segment in the pharmaceutical sector. Additionally, refinements in new concepts such as regenerative drugs are gradually being refined. This in turn is offering immense opportunity for the growth the market. Among the top 15 biopharmaceutical products, the most of the drugs currently available in the market are biopharmaceuticals. Hence, majority pharmaceutical firms across the globe are progressively shifting their R&D focus to macromolecule products.

Restrain

High priced& time-consuming drug development process to hamper the market growth

As per the California Biomedical Research Association (CBRA), a medicine takes on an average of 12 yrs to get from the lab to the patient, with toxicology studies taking 1–6 years. Furthermore, only 5 out of every 5,000 medications that begin preclinical research make it to human trials. Furthermore, late-stage failure in the medication development process raises R&D expenditures and reduce pharmaceutical company profit margins. Furthermore, tight rules on the protection & efficacy of pharmaceuticals, as well as raw materials including excipients, necessitate the improvement of current quality checks and production procedures, which increases the overall production cost. As a result, even if the medication development process has advanced significantly in recent years.

Opportunities

Proliferation of pharmaceutical industry in emerging economies

In recent years, the development of pharmaceuticals sector has been hampered owing to the government induced regulations on reducing healthcare costs and the mitigating medicine pipeline. This in turn has encouraged the pharmaceutical manufacturers to expand their manufacturing plants in the developing markets. The key players can take financial benefits including low-cost of production with regard to tax rates as well as lenient administrative guidelines.

Challenges

Safety and quality concerns

Recently changes in the government rules and regulations around the world, the prospective trade policies can present a challenge for the pharmaceutical sector and, therefore, for the pharmaceutical sector. Trade among the developing countries that are considered emerging countries such as China, India and Brazil and developed countries such as the United States as well as countries of European region, which are the main markets of the industry, could be severely affected. Important. The potential impact of the UK’s departure from the EU has prompted companies to consider moving – or shifting – their production from UK to France,Germany, and other European countries. While the impact of BREXIT on the pharmaceutical industry remains unclear, companies such as Astra Zeneca, Novartis, and Roche have relocated their production sites to reduce additional risks.

Key Market Developments

- In 2020, Colorcon has launches the Acryl-EZE II film coating line which extends the pH range covered by its enteric coatings.

- In 2019, Ashland has introduced Aquarius Nutra TF that provides titanium oxide-based coating to tablets in the European market.

- In 2018, Roquette has signed an agreement with Thermo Fisher that provides Thermo the right to distribute Roquette’s products in the US and Canada. This will offer further market access to Roquette.

Pharmaceutical Excipients Market Companies

- Ashland Global Holdings

- BASF SE

- DuPont

- Roquette Feres

- Evonik Industries AG

- Associated British Foods

- Archer Daniels Midland Company

- Lubrizol Corporation

- Croda International

- Kerry Group

Market Segmentation:

By Product

- Organic Chemicals

- Inorganic Chemicals

- Others

By Functionality

- Fillers and Diluents

- Suspending and Viscosity Agents

- Coating Agents

- Binders

- Disintegrants

- Colorants

- Lubricants and Glidants

- Preservatives

- Emulsifying Agents

- Flavoring Agents and Sweeteners

- Other Functionalities

By Formulations

- Topical Formulations

- Oral Formulations

- Parenteral Formulations

- Other Formulations

By End-Users

- Pharmaceuticals Companies

- Research Organization

- Academics

- Others

By Distribution Channel

- Online Pharmacy

- Retail

- Mail-Order

By Excipient Type​

- Lactose-based Excipients

- α-lactose monohydrate

- Anhydrous α-lactose

- Anhydrous β-lactose​

- Amorphous Lactose​

- Cellulose-based​

- Microcrystalline Cellulose (MCC)​

- Cellulose Ethers​

- Others​

- Starches​

- Carboxymethylcellulose Sodium (CCS)​

- Sodium Starch Glycolate (SSG)​

- Fine Chemicals​

- Mannitol

- Biopharma Excipients​

- Others​

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Esoteric Testing Market Size to Hit USD 75.54 Bn by 2032 - July 17, 2024

- mRNA Therapeutics Market Size to Surpass USD 39.99 Bn By 2033 - July 17, 2024

- Acne Treatment Market Size to Hit USD 15.86 Bn by 2033 - July 17, 2024